Transaction Code 570 and Delayed Tax Refunds

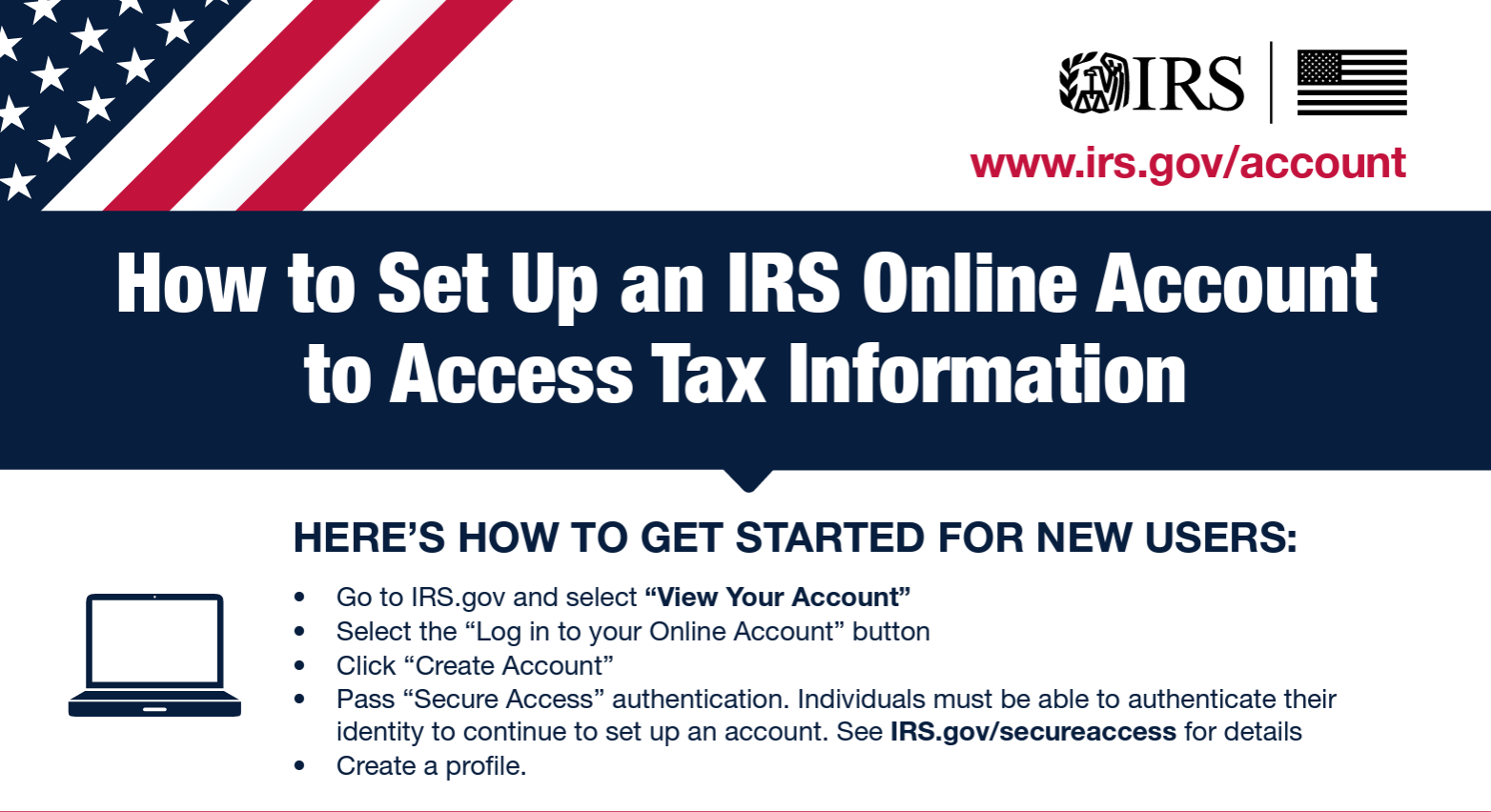

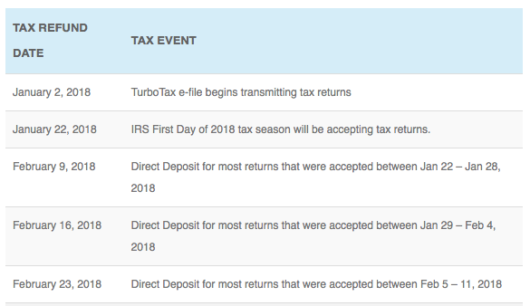

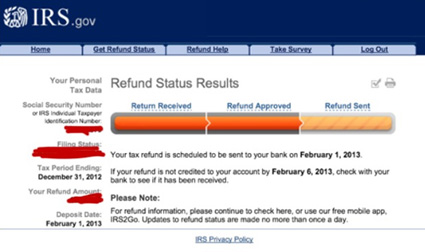

Transaction Code 570 Usually, around two weeks into tax season, we notice a surge of questions about the timing of refunds and IRS Transaction Code 570 that shows up on an IRS account transcript. Sometimes it feels like the tax season is progressing more slowly than previous years. Taxpayers see others getting updates through the … Read more