Do you have a tax refund offset or Tax Topic 203 appearing when you check the WMR?

Do you have a tax refund offset or Tax Topic 203 appearing when you check the WMR?

Recently the topic of a tax refund offset came up in our forum. There seems to be a lot of questions about what the IRS can take from a tax refund, and how it all works. So, after doing a little research for some answers, here’s what we’ve come up with so far. First, the department that actually handles the offsets is Financial Management Services (FMS).

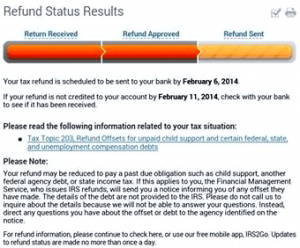

FMS is responsible for collecting delinquent debts and forwarding them to the agency to which they are owed. In most cases, FMS will send a letter prior to the offset to notify you that your refund is in danger of being offset. The letter includes both the name and Social Security number of the taxpayer for which the refund is being offset, as well as the organization to which the offset is being forwarded and the amount of the offset. If you do not receive the letter, however, call FMS to inquire as to the status of your income tax.

The phone number you should use to find out if you have an offset is: 800-304-3107. I called this number myself just to see how it works. Basically it will ask you for your social security number and run a search to see if there are any debts or offsets against you. The message also states that the hotline is updated daily. If you’d like more information on the FMS, this is the link that was used for the above information: How to Check Your Income Tax Offset Refund Amount.

So, now that we have a better understand of who collects any offsets, you may be wondering what exactly could be taken from your tax refund. The following list of was found here:

What Debts Can Be Taken From Your Federal Taxes?

Federal Debts The IRS pays itself first, so federal tax debts take precedence over other types of debts when it comes to offsetting your tax refund. If you failed to pay taxes due in previous years or you owe money to the IRS for any reason, the agency will partially or fully offset your refund to collect these funds.

Non-tax Federal Debts If you are up-to-date on your federal taxes, but you owe money to any other federal agency, the IRS can take money from your tax refund to satisfy these debts. Federal agency non-tax debts include past due or defaulted student loan payments, payments on HUD loans and any fines, penalties or fees due to any federal department. If you’ve accepted overpayments or fraudulent payments on Social Security or disability benefits or other federal insurance programs, these debts may also cause your refund amount to be reduced.