Where’s My Refund Messages

Tax Topic 152 with no bars is a common screen people will see when they check the status of their tax refund. When the IRS has received your tax return and you check the status of your tax return on the IRS Where’s My Refund tool, you might see various messages. These are some examples. Read Tax Topic 152 Explained since it is the most common phrase people we see when they check their refund status.

- No Bars – We cannot provide any information about your refund. – Tax Topic 152

- No Bars – PATH Act – Tax Topic 152

- Return Received (1 Bar) We have received your tax return and it is being processed. – Tax Topic 152

- No Bars – Your tax return is still being processed. – Tax Topic 152 (IRS2go version)

- No Bars – Your tax return is still being processed. – Without Tax Topic 152 (IRS2go version)

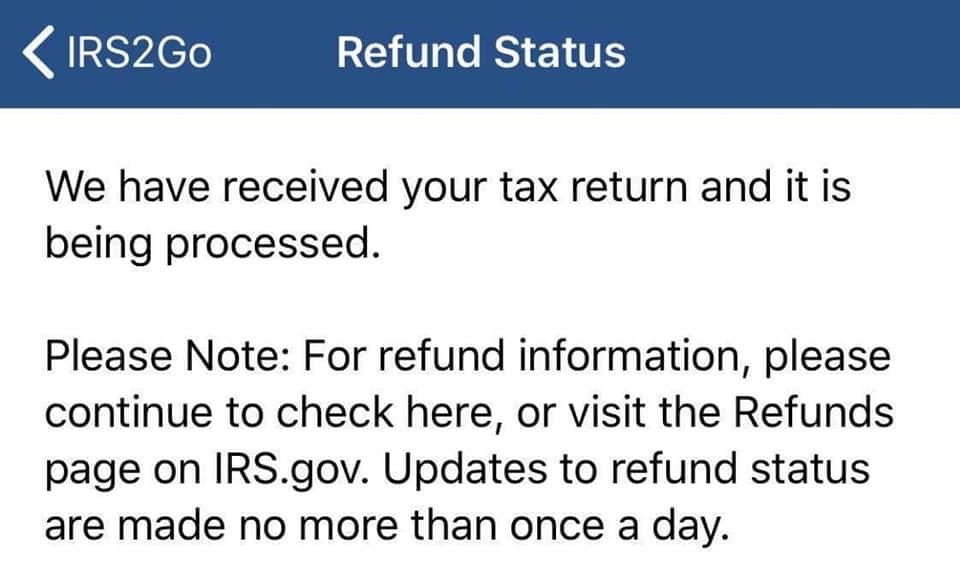

- We have received your tax return and it is being processed.

- We have received your tax return and it is being processed. (IRS2go version)

- Refund Approved (2 Bars) Your refund is scheduled to be sent to your bank by [date].

- Refund Approved (2 Bars) Your refund is scheduled to be sent to your bank by [date]. (IRS2go version)

- Refund Approved (2 Bars with Offset) – Your refund is schedule to be sent to your bank by [date]. (Tax Topic 203)

- Take Action

- Reference Code 1541

- Take Action (Audit) with Reference Code 1242 (Tax Topic 151)

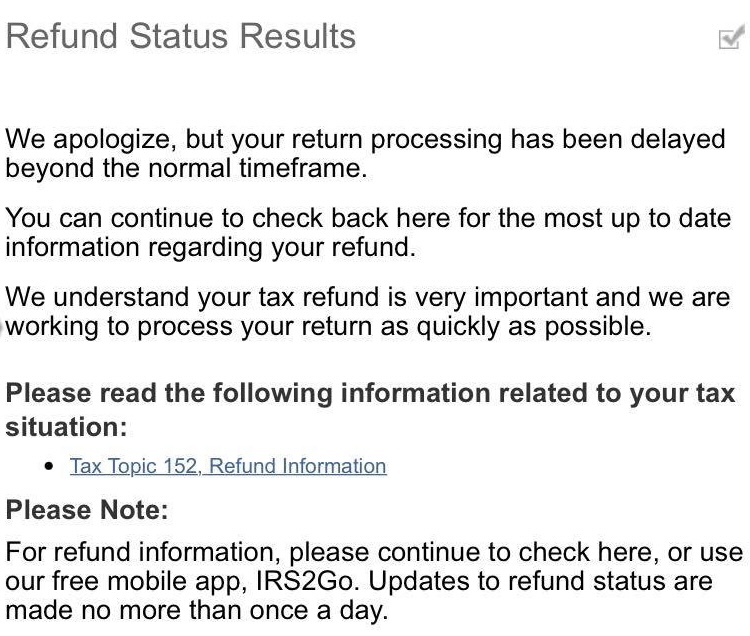

- No Bars- Your return processing has been delayed.

Read more: Tax Topic 152 Explained.

1. Tax Topic 152 No Bars

We cannot provide any information about your refund. You must wait at least 24 hours after you get the acknowledgement e-mail that your tax return was received. If it has been more then 24 hours it does not mean there is a problem with your tax return.

2. PATH Act

According to the Protecting American from Tax Hikes (PATH) Act, the IRS cannot issue refunds before mid-February for tax returns that claim the Earned Income Tax Credit or the Additional Child Tax Credit. This applies to the entire refund, even the portion not associated with these credits. Check Where’s My Refund in mid- to late February for your personalized refund status. It’s updated once a day and remains the best way to check the status of your refund.

(Tax Topic 152)

You can read more about the PATH Act here.

3. Return Received (1 Bar)

We have received your tax return and it is being processed. If you filed a complete and accurate tax return, your refund should be issued within 21 days of the received date. However, processing may take longer under certain circumstances.

4. No Bars. Your tax return is still being processed. (IRS2go version)

A refund date will be provided when available with Tax Topic 152

5. Your tax return is still being processed. (IRS2go version)

A refund date will be provided when available without Tax Topic 152

For more details on “still being processed” check out our page on re-sequencing here.

6. We have received your tax return and it is being processed.

7. We have received your tax return and it is being processed. (IRS2go version)

8. Refund Approved 2 Bars. Your tax refund is scheduled to be sent to your bank by [date].

9. Refund Approved Bars. Your tax refund is scheduled to be sent to your bank by [date]. (IRS2Go version)

10. Refund Approved Bars (with Offset). Your refund is scheduled to be sent to your bank by [date].

Tax Topic 203

Your refund may be reduced to pay a past due obligation such as child support, another federal agency debt, or state income tax. If this applies to you, the Financial Management Service, who issues IRS refunds will send you a notice informing you of any offset they have made.

11. Take Action

In some cases, the Take Action message on Where’s My Refund will also have a reference code. Lookup what the IRS reference code means in our index of IRS references codes.

12. Reference Number 1541

Please have the following available if you call:

- A copy of this page.

- A copy of your tax return

- The Social Security Number, Filing Status, and refund amount claimed on your return.

- Any notice that you have received concerning your refund.

- Reference Number 1541 ext 312

- 1-800-829-0582

13. Take Action (Audit)

Tax Topic 151 Your Appeal Rights

If you have questions or need additional information, please have the following on hand when you call:

- A copy of this page

- A copy of your tax return

- The Social Security Number, Filing Status, and refund amount claimed on your return.

- Any notice that you have received concerning your refund.

- 1-800-829-0582 ext 362

Please Mention Reference Number 1242

We talk more about the “Take Action” message here.

14. No Bars- Your return processing has been delayed beyond the normal timeframe.

We apologize, but your return processing has been delayed beyond the normal timeframe. You can continue to check back here for the most up to date information regarding your refund. We understand your tax refund is very important and we are working to process your return as quickly as possible.

(Tax Topic 152)

Comments are closed.