Key Points:

IRS Transcript Service

There are three ways to get an IRS transcript. You can use the online, phone or mail request. You can order copies of tax records for past tax returns, account information, wage and income statements and verification of non-filing letters. The easiest and fastest way to get a transcript is to access your IRS Online Account. If you need an actual copy of your tax return, you must use the mail request method.

Online Request

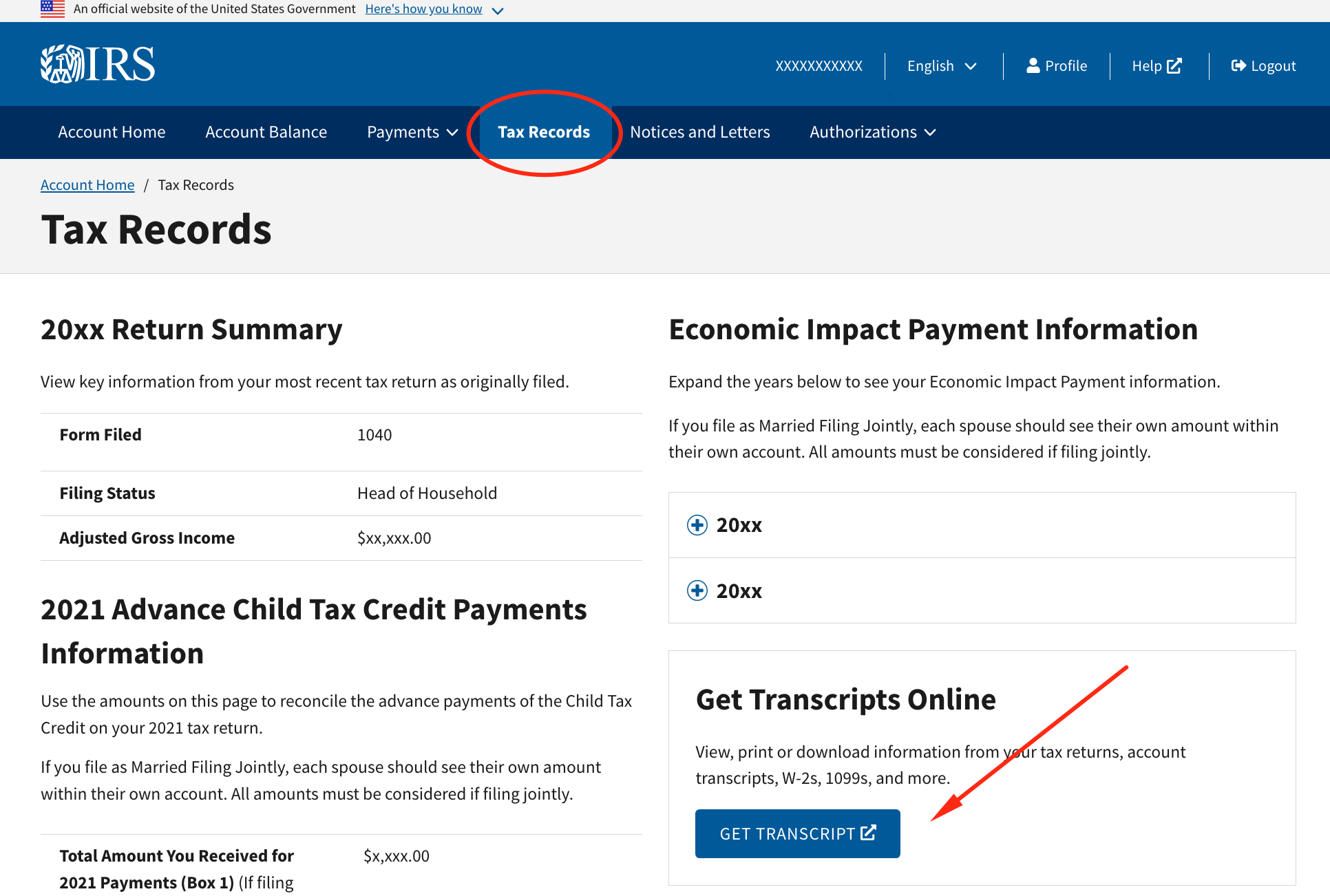

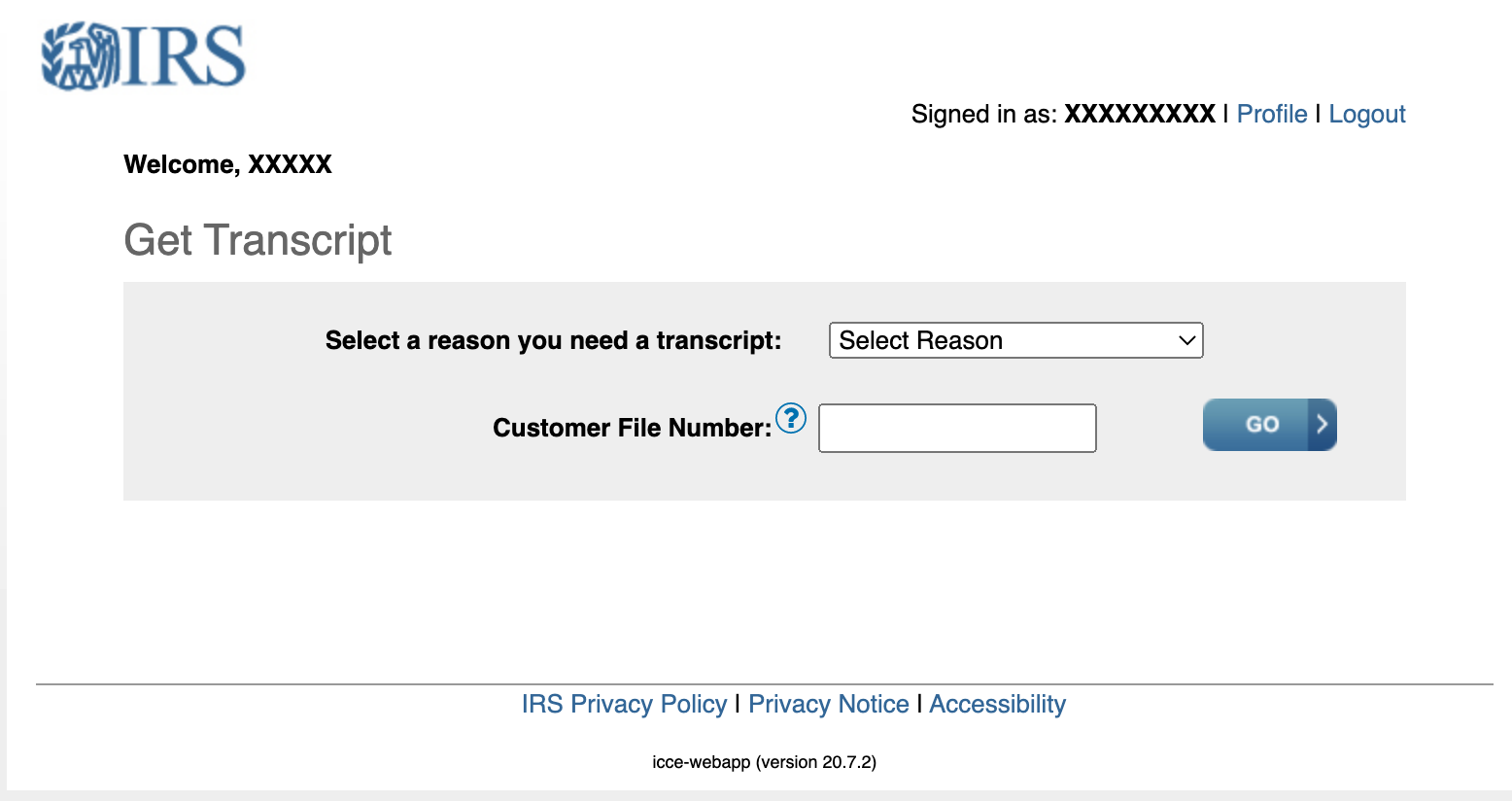

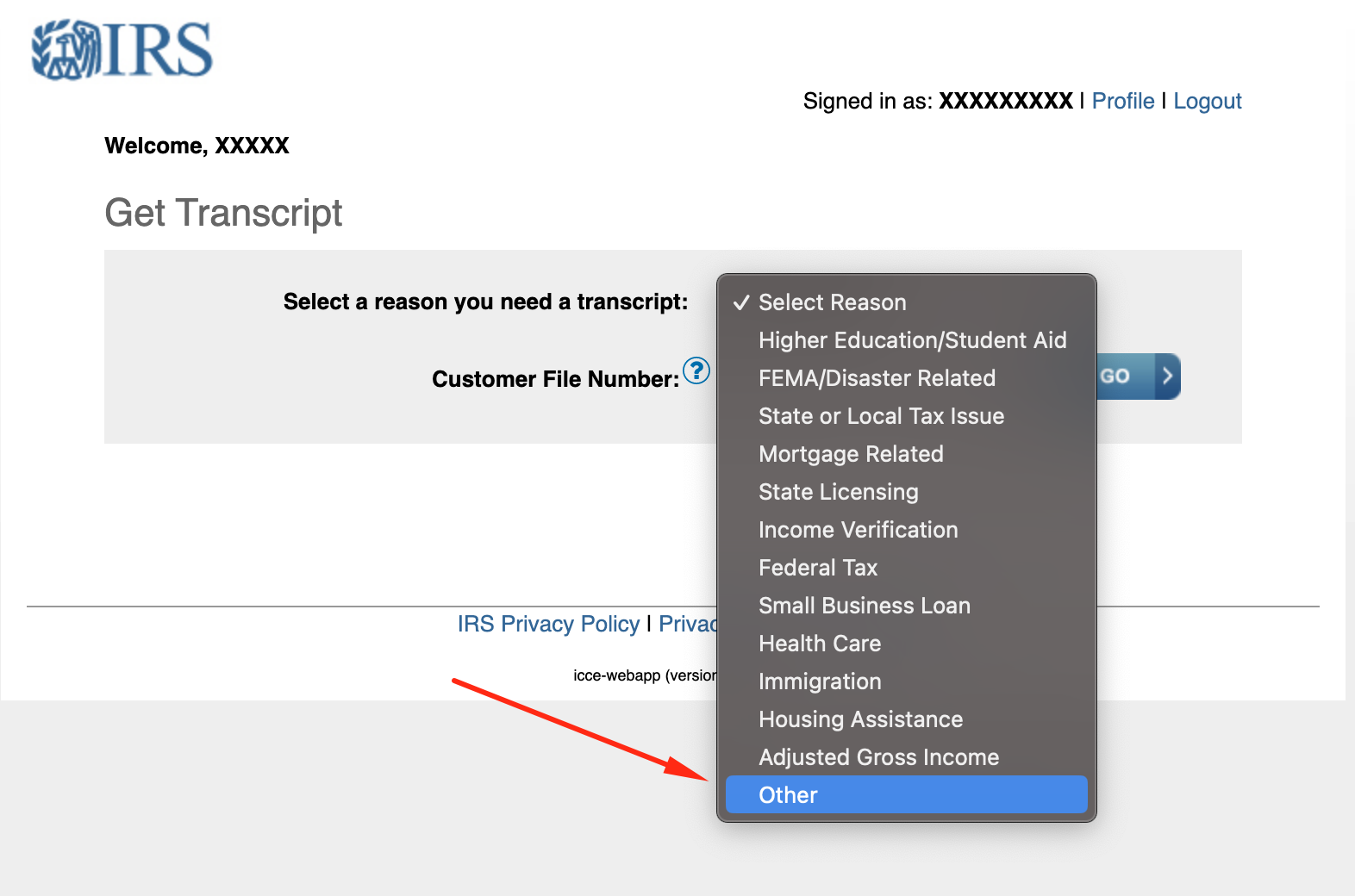

The IRS Get Transcript Online tool is a service to access your tax account records online. With an online account you can also look at your payment history and see your prior year adjusted gross income (AGI). To use this tool, you need to create an account with the IRS and pass a two-factor authentication process. Once you are authenticated, you can view, download or print your transcript.

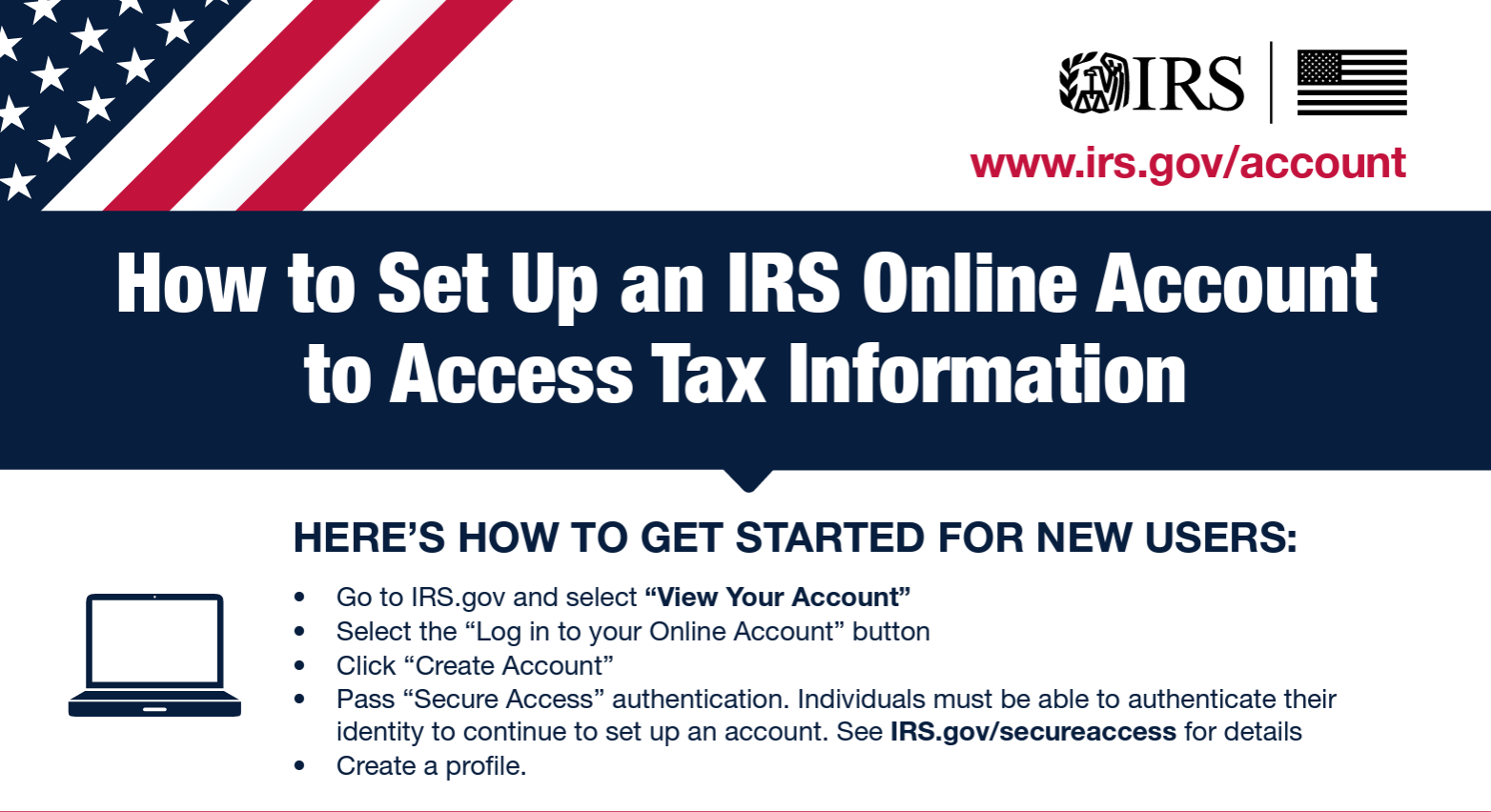

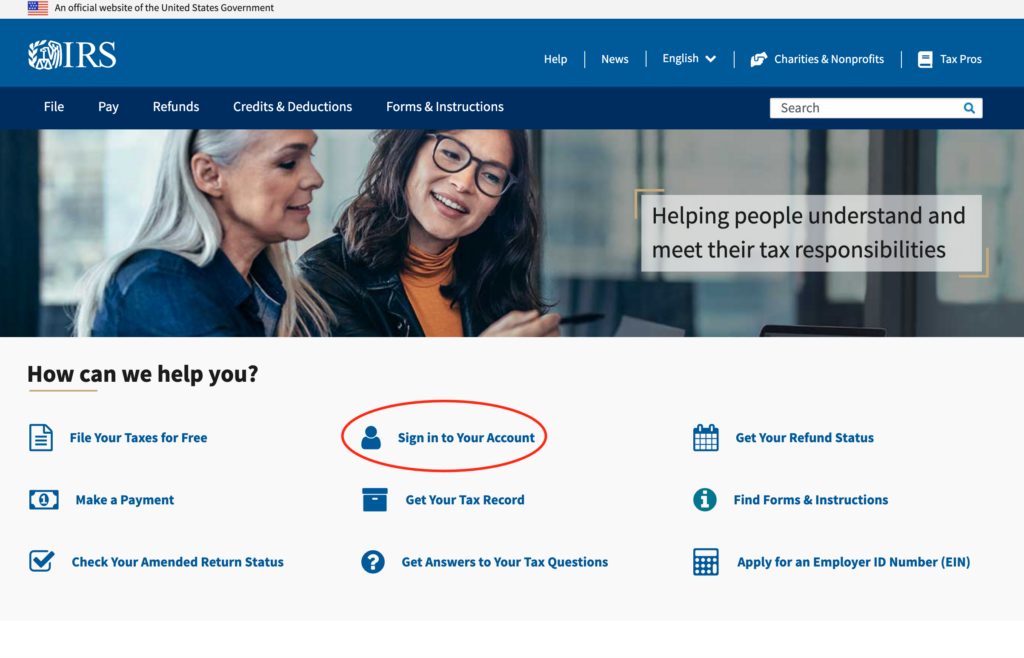

How to use IRS Online Account to access transcripts.

Go to irs.gov/account to setup or login to your online account. If you already have an IRS account you can go directly to the IRS get transcript page to login.

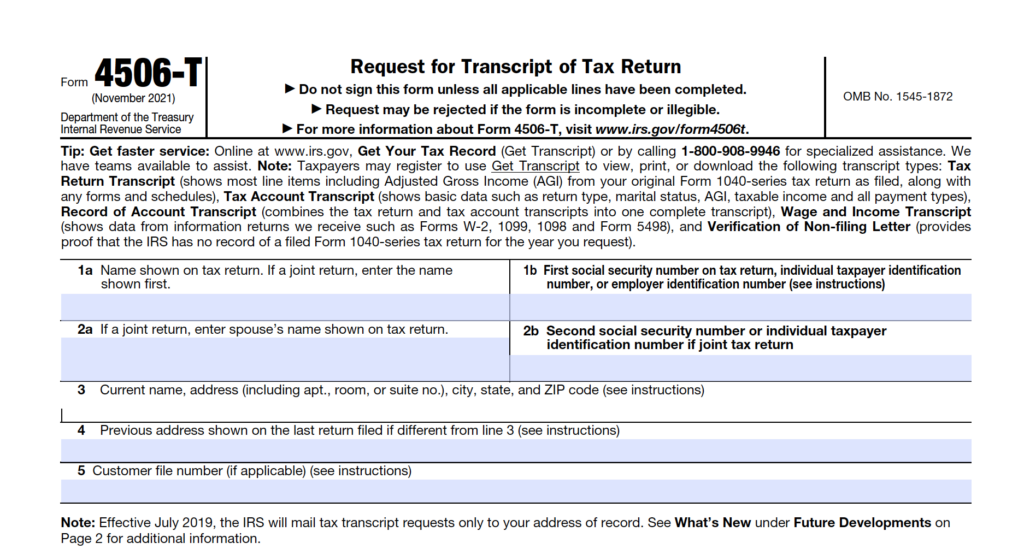

Mail Request

You can also use mail a request for your IRS transcript by completing Form 4506-T and mailing it the address listed on the form. The form and instructions are available at IRS.gov Form 4506-T. You can request a tax return transcript which shows most line items from your tax return, or a tax account transcript which shows basic data from your tax return as well as any changes made to your account after you filed. You will receive the transcript by mail within 5-10 days.

Phone Request

Another way to access transcripts is by phone request. You can call the IRS at 1-800-908-9946 and follow the automated prompts to request your transcript. It is necessary to provide your Social Security number, date of birth, and the address on your latest tax return. You will then receive the transcript by mail within 5-10 days.

Check status of your tax refund with an IRS transcript

The different types of transcripts are tax return transcript, tax account transcript, record of account transcript, wage and income transcript and verification of non filing-letter. You can use the account transcript to see actions made to your tax account while your tax return is processing. To help read a transcript we explain them and the codes are in our IRS transaction codes index. These transcript codes help indicate if your tax return is being processed and when your tax refund will be issued. You can also see adjustments made to your account after the tax return was filed.