key tax return and refund dates

When can you file your taxes?

You can submit your tax return before the IRS begins processing as early as the first week of the year with many tax preparation providers. You don’t need to wait until the IRS begins accepting tax returns but you must have the proper forms and paperwork. Some forms are not available until mid January. Tax returns filed before the IRS officially opens sit in a “queue” and are held until the IRS officially begins accepting tax returns.

Your tax return may be selected in a test batch. If you e-file early and it sits in queue, your return may be sent to the IRS early. This can result in early direct deposits depending on the payment provider you select. Our cycle chart will update with key dates including test batch dates.

When does the IRS accept tax returns?

The IRS usually opens around the third week of January each year. They announce the opening date early in January.

The IRS will begin accepting tax returns in 2025 on January 27th.

When is the IRS test batch?

If you file your tax return early, it may be sent to the IRS in a test batch before the IRS has officially opened for the year. It is usually a week before the date the IRS begins accepting tax returns. This has resulted in refunds in the past that can be posted by direct deposit as early as the day after tax season opens.

When will I get my tax refund?

Early filers whose returns are accepted in a test batch can anticipate a tax refund as early as the day after the IRS opens the January filing season if your return was in the test batch. The day that the IRS deposits refunds varies for regular returns but we notice trends based on the method you chose to file and select to direct deposit. You can use our tax refund calendar or refund cycle chart to help find out when you will get your tax refund.

Where is the IRS refund cycle chart?

The official tax refund cycle chart published by the IRS has been eliminated and replaced with IRS FAQ. Refund cycle charts are now published by independent websites and vary slightly.

A good reference to use is the When To Expect My Refund cycle chart that is published early each year by the College Investor.

tax refund grapevine

This is a user-to-user community of taxpayers. Share experiences and ask questions below in our Live Discussion. We have learned more about tax refunds than we ever wanted to know.

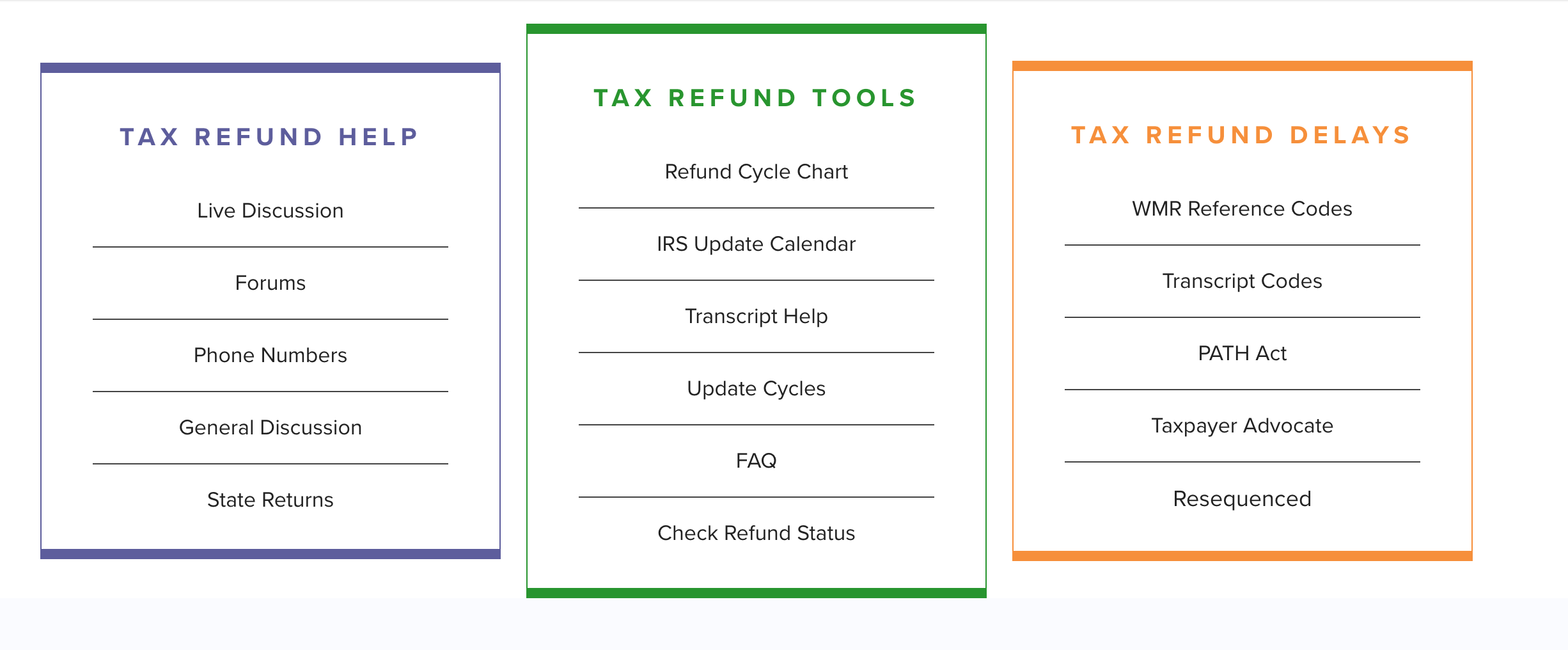

tax refund tools

IRS Update Cycle

Use the IRS Update Cycle chart to find the days and times the WMR and transcript update.

When are Updates?

The IRS has regular mass update cycles.

WHEN DOES WHERES MY REFUND (WMR) UPDATE?

Where’s My Refund can update any day of the week. But there are mass updates on Wednesday and Saturday when a lot of people see an update. Use our calendar to find out what day you can expect to see updates on Where’s My Refund.

WHEN DO transcripts update?

Transcripts can update any day of the week. But there are mass updates on Tuesday and Friday. Use our calendar to find out what day you can expect to see an update on your transcript.

Update… State was just accepted 2 mins ago. My federal and state was accepted. Filed turbotax Jan 10, paid fees upfront, federal ass accepted the 19th state accepted today and I’ma pather, now just the wait till the 16th when transcripts update, right after 846 I should receive it in the afternoon since paid fees upfront.

Returns not reforms lol

My Indiana and Arkansas state reforms were just accepted

@California girl83: I filed 1/4/24 and was accepted on 1/19/24 so couple weeks I wouldn’t stress to much it’s only been 2 days

@California girl83: they pull just small test batches prior to officially accepting returns on 1/29. We think they will continue testing through Thursday.

If accepted early, our refund cycle chart shows what we think will happen next.

https://igotmyrefund.com/irs-e-file-refund-cycle-chart/

I filed on January 20th still haven’t been accepted yet. I filed with Free Tax USA….😒🤔

@Sheila_33: yes my first bar is showing. But I know it could still take up to 21 days to process. But I do t have the EITC or actc so hopefully they can complete my return in the next week or 2 if no errors

@jemar707: Thank you. This is actually what I read online as well.

Posting if it helps someone

Sent on Friday with Free Tax USA. Accepted today. W2 and dependents. In other news stilllll waiting on my 2021 amended return that was received 2/23

I am still waiting – was hoping for early acceptance simply because we anticipate someone trying to claim dependents they have no right to and are trying to beat them.

Just an FYI to those who may get accepted in test batches: Don’t be alarmed if you don’t see your info recognized on the Wmr for the first 24 to 48 hours. It can take that long for it to acknowledge it. I was accepted on Tuesday afternoon and my Wmr didn’t update until Thursday morning. :)

@Patiently waiting in the 954: As long as you don’t have any of the path credits (eitc, actc), then it’s possible, as long as everything goes smoothly.

@jemar707: it’s possible it came through on Saturday. But I checked Saturday afternoon and it was not accepted at that time so it happened either late Saturday or Sunday.

@sheila_33 my return is showing received and is processing. Does that mean I am in the test batch. Also I have no kids to claim this year, so does that mean they can actually process me soon if everything is ok in my return.

@hope: It will automatically update if the R’s finally come around. It could be for cute puppies, and the R’s would say no. Get a 3rd job in the hours you sleep lazy 😀

🍇 @everyone:

Pro Tips.. a lot of the answers and links we share are from the areas above the comments. We tried to aggregate as much information for people to get into the new design this year. Get ready to dive in as things get moving! scroll up.

Also, if you are at the top of the page and come back frequently, you can use the green GET HELP button to jump down to the comment box. Or the light purple bar to go straight down to the comments. But you will be tested that you read all the content! lol

@Sheila_33: a glimmer of hope for the rest of us!! :)

@Joe shmore: It’s possible.

Never mind, just checked on FB and there are several more that were accepted today.

I’ve seen two people so far in this forum get accepted today. So it seems like not as much as they did last week.