Home › Forums › General Discussion › 2021 Tax Season › ‼️🚩 Payment Status #2 – Not Available WILL NOT RECEIVE AUTOMATICALLY

- This topic has 229 replies, 32 voices, and was last updated 4 years ago by Luna_Meadows87.

-

Topic Starter

-

January 6, 2021 at 6:44 am #4440530

The IRS announced this here. We are discussing it below and on this post.

https://www.irs.gov/newsroom/irs-statement-about-second-economic-impact-payments

Payment Status #2 message on the Get My Payment tool

The IRS now says that people receiving the Payment Status #2 message on the Get My Payment tool will have to wait until they file their 2020 taxes to get the payment, even if they received the first stimulus check with no issues.

“The IRS advises people that if they don’t receive their Economic Impact Payment, they should file their 2020 tax return electronically and claim the Recovery Rebate Credit on their tax return to get their payment and any refund as quickly as possible,” notes the agency.

A spokesperson for the agency did not clarify why this is the case or why the issue seemed to affect those who had filed their 2019 taxes through H&R Block and TurboTax in particular.

Payments also sent to incorrect bank accounts

Many people — particularly those who filed their 2019 tax returns with H&R Block and TurboTax — are also reporting that their payments were sent to incorrect bank accounts.

The IRS says the banks that received the payments will need to return the money, and then the IRS can reissue them to the correct accounts.

As of Tuesday night, some people who filed via H&R Block and initially had their payments sent to the wrong account reported to CNBC Make It that their stimulus payments had been deposited successfully into their actual checking accounts.

Only the IRS can issue the stimulus payments, so the agency is encouraging people to check its website for updates about ongoing issues, rather than their financial institutions or tax preparers. It also notes that its phone representatives don’t have additional information beyond what’s on the IRS website.

-

-

AuthorReplies

-

-

March 14, 2021 at 8:56 am #4471559Luna_Meadows87

You can still E File 2020 successfully. At the end of tax preparation while choosing to E-File. when you have to enter your prior years AGI, Check the box that you did not file a return last year. ( Because as of now, to the IRS you have not. Until your mail is processed). So, I checked no return for previous year, entered my license information and it was accepted by the IRS a few hours later.

-

February 22, 2021 at 10:04 am #4457633FLGirl

Your transcript for 2020 will show all payments (stimmy and tax return)

Mine shows both of my stimulus payments (plus the error on the second – where they sent my DD, then canceled and reissued 2/3)

It also shows my 846 code for my tax return with a DD of 2/24/2021 -

February 22, 2021 at 10:00 am #4457629Andrew

I like exactly the same codes on my transcript. Are these just related to the stim payments

-

January 29, 2021 at 8:02 pm #4450630TLC

Found these codes on my account transcript. Looked it up but no solid info.

290 – addition tax assessed 4/27/2029 $0

971- notice issued cycle date includes on 4/27/2020 (No letter received)

570 – additional account action pending $0 -

January 29, 2021 at 7:21 pm #4450622JRoy

Thought everybody saying they finally got it we’re bots or government shills.

Got mine today

Original message said scheduled to be mailed 01/06. Good luck to all who haven’t received them yet.

Oregon. -

January 29, 2021 at 7:16 pm #4450620Sherbear

Gmp still says unavailable, this morning on my transcripts it finally updated to 2/3 and when I checked my bank acct (credit union) after 5pm my money was in there. Yay!!! It’s finally coming guys!!

-

January 28, 2021 at 4:28 pm #4450255Mj

Still status 2 so whoever is still waiting your not the only one. Im done looking at expecting a refund. At this point I’m over it. Everyone around me has gotten theirs and using it to party. I generally just want to pay bills!

-

January 28, 2021 at 6:59 am #4450069KG4

Get my payment gave me that message up until yesterday. Now it says I have a DD scheduled for tomorrow. My husband still has the same message that status not available.

-

January 22, 2021 at 10:25 pm #4448441Amexserve

Excuse my typo. 2019 mailed tax returns may still not be process check IRS site wheres my refund and call IRS number to verify tax return status .. Use all resources available as well as information on posts from other filers

-

January 22, 2021 at 4:49 pm #4448355Amexserve

If you filed return last year and mailed ii they maybe still not finished processing terms. IRS site stated as of Oct thru Dev they still had 11 million pieces of mail not opened which tax returns were possibly included in them. Everyone please post https://igotmyrefund.com/forums/topic/second-stimulus/

-

January 22, 2021 at 4:31 pm #4448348Amexserve

Jerniski Dorsey

Please join the primary forum where most if the posts are about stimulus payment. First thing is to get on call with the IRS rep.

Have you checked getmypayment IRS. Did you check where’s my refund IRS site. Here is the link to the main forum https://igotmyrefund.com/forums/topic/second-stimulus/ -

January 22, 2021 at 3:40 pm #4448338Amexserve

Layla

Dial number. Press option lost. Replace and put in info. If asks to replace card hang up call. So it’s a card and not a check. See link to website come join the other forum for stimulus chat

https://www.consumer.ftc.gov/blog/2020/07/activate-your-eip-visa-debit-card-now -

January 22, 2021 at 3:39 pm #4448337Amexserve

Layla. Do not send the stimulus payment back if you receive it. You will be waiting forever for them to resolve that issue Check to see if they issued you a card instead of check.

See next post -

January 22, 2021 at 3:32 pm #4448334Amexserve

Layla tax.

You need to be on the other forum where most of the filers use and have solutions and share their experience. Lots of people should are awaiting still for checks. IRS has been slow to actually get them to the USPS for delivery. Here is the link

.

https://igotmyrefund.com/forums/topic/second-stimulus/ -

January 22, 2021 at 12:52 pm #4448257LaylaTex

Ok husband has not received his stimulus. (We got married 4/13/2020) says check mailed 1/6. I have not gotten my stimulus went to a closed bank account. I have went a head and completed my taxes and put we have not received the stimulus, if we do recieve them we should return the checks correct? or will we have to file an amended return?

-

January 22, 2021 at 9:58 am #4448201Brad

My Payment status is “Not Available”…so according to them, I won’t be getting the refund. However, on my transcript, it shows Refund issued on the 4th, and Credit to my account on the 18th. Also, Informed Delivery on the 20th gave me a notice from the Treasury that I would be receiving and EIP card in my mailbox soon. Has anyone else fit any of this and gotten their payment? If so, how long after the Informed Delivery notice did you get it?

-

January 21, 2021 at 7:15 am #4447738Amexserve

I believe they are still resolving issues past the 15th with stimulus 2 payments to filers. IRS mentioned if they issued a check and not received in 4 weeks to call them. They will trace it and reissue a new one

-

January 21, 2021 at 7:11 am #4447737Amexserve

Joan James

Set up informed delivery with USPS. It will notify of all mail being. Delivered. Check to see if it is a debit card Press lost or stolen..Enter info. If asks to replace card hang up if not found possibly a check to receive.. https://informeddelivery.usps.com/box/pages/intro/start.action

https://www.consumer.ftc.gov/blog/2020/07/activate-your-eip-visa-debit-card-now -

January 19, 2021 at 1:07 pm #4447081

anyone have any update with transcripts showing 1/18/21…………. I have 4 letters on informed delivery 2 are for sure my transcripts and 2 do not show image but on the bottom it don’t say anything about economic payment like others get when they dont have an image for theres……….

-

January 17, 2021 at 5:28 pm #4446650Melbelle

My irs transcript says money was direct deposited into my bank account on 1/4/2020. I use Suntrust bank and they said it must have gone to the wrong account and that someone at the IRS must have put an incorrect number in? Checked tax transcript and it says code 846 date of 1-18-2021. I’m hoping that I get it tomorrow but not holding my breath. If we have to claim this at tax time I sure hope that it doesn’t hold up getting our refunds.

-

January 16, 2021 at 11:21 am #4446345Erik NJ

Dorsey file for the rebate on the 2020 taxes.

Erik in NJ got my check came Wednesday -

January 16, 2021 at 12:29 am #4446182Jerniski Dorsey

I mailed my return on March 2020 and still haven’t received Refund neither first or second stimulus is there any way I can still receive my stimulus someone please help me out

-

January 15, 2021 at 10:22 pm #4446156Brian

I’m not sure it is, but Brenda please remove any personal data you have put in your posts.

-

January 15, 2021 at 12:18 am #4445627

Get my payment tool says mailed 1/6. Still not here 1/14. Colorado.

-

January 14, 2021 at 9:48 pm #4445587sanwells

-

January 12, 2021 at 6:39 am #4444485Sophia

Update dd info for TT or check your emails for same link with message from TT.

Once updated they say within 5 business days you should get deposit. -

January 11, 2021 at 9:51 pm #4444421Joan James

The “Get My Payment” website tells me my check was mailed on January 6th. It is now January 12th and I still haven’t received my $600 check. How do I track the check to determine if it REALLY was mailed, and if so, where die it go?

-

January 11, 2021 at 9:16 pm #4444416Nita

Is anyone showing an 846 code for 1-18-2021? Does that mean its coming that day?

-

January 11, 2021 at 2:53 pm #4444336

-

January 11, 2021 at 2:33 pm #4444333Aline

So if you did not have your 2019 return fully processed, then you don’t receive a second stimulus check. I didn’t receive a refund for 2019 now no second stimulus.

This is so wrong!! -

January 11, 2021 at 10:58 am #4444258Jk2016

Have not received nothing yet

-

January 11, 2021 at 10:58 am #4444257Jk2016

Transcript 1/4/2021

Get my payment status- unavailable

Did taxes for 2019 with a personal tax preparer -

January 11, 2021 at 10:36 am #4444247

Anybody here transcripts date 01/04/2021 deposit code 846 on transcripts but hasn’t gotten anything yet ?

-

January 11, 2021 at 10:16 am #4444241

Update from IRS

https://www.irs.gov/newsroom/irs-statement-jan-10-2021-update-on-economic-impact-paymentsso basically another nothing for you statement..oh man, what a life

-

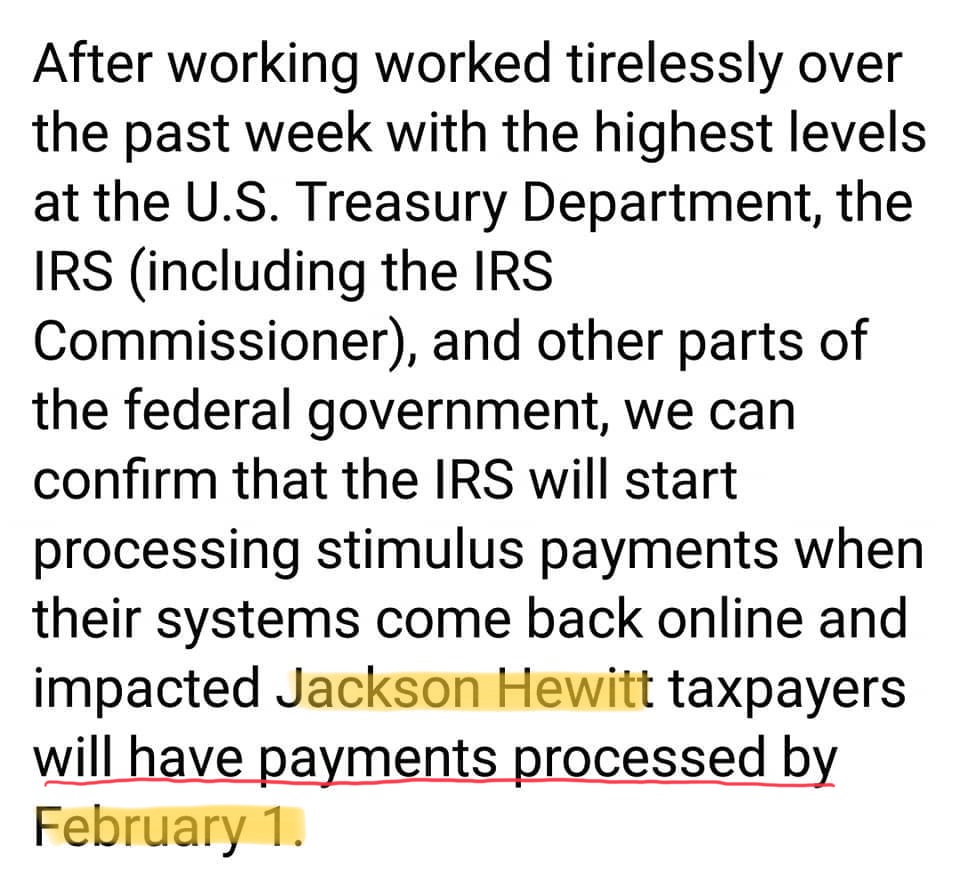

January 11, 2021 at 9:47 am #4444219Lexie

Since Jackson Hewitt wants to be dicks! They will not be processing stimulus payments till February 1st!! It’s a shame bc a lot of families was praying for this money and they don’t give a damn!

-

January 11, 2021 at 9:09 am #4444212FLGirl

-

January 11, 2021 at 8:03 am #4444201Rebecca

Why does it say for 2nd payment not enough information yet working on it does that mean I gotta file a tax return to get it this is ridiculous why do they gotta make it so difficult we are the ones suffering while they get to live gud

-

January 10, 2021 at 10:16 pm #4444119Aline

Does that include people who filed there own taxes and had D.D? That did not receive there 2 stimulus, with Payment Status #2 – Not Available WILL NOT RECEIVE AUTOMATICALLY.

-

January 10, 2021 at 4:31 pm #4444091

-

January 10, 2021 at 2:01 pm #4444073Aline

I filed my own taxes.

Received first stimlus payment fast,second not available.

I have know idea what’s going on with IRS!!Has anyone received there 2 stimulus D.D when they filed there own taxes?

Payment Status #2 – Not Available WILL NOT RECEIVE AUTOMATICALLY

-

January 10, 2021 at 11:24 am #4444050

I GOT MY DD on the 8th but I didn’t know until today. So hopefully I can give others some hope. My status on the WMR still says Status Unavailable. I used a personal tax preparer (not well known like H&R or Turbo tax) I never got any email from anyone. I didn’t contact my tax preparer. I didn’t contact IRS. I didn’t do anything except hope and continue to check WMR. I checked my transcripts also. Had the 1/4 as date refund was issued.

-

January 10, 2021 at 3:16 am #4443784T

My status #2 isn’t available; They made an attempt to deposit my second stimulus check into Republic Bank which was only a temporary account in 2020. I received my 2020 stimulus into the correct account even after RB account was closed smh I am not sure how this happened. Does anyone know if checks will be mailed or just have to wait to file?

-

January 9, 2021 at 10:04 pm #4443761Lexie

So supposedly Jackson Hewitt is working with the irs to get everyone stimulus dd this week 🤞

-

January 9, 2021 at 7:40 pm #4443739Aline

I have had the same bank and address for over ten years,and filed my own taxes.

Received first stimlus payment fast,second not available.

I have know idea what’s going on with IRS!!Payment Status #2 – Not Available WILL NOT RECEIVE AUTOMATICALLY

-

January 9, 2021 at 4:24 pm #4443707Jayson

SHELLY:

Wrong. Employers don’t have to wait until the last day of January to send W-2 forms. They must mail them NO LATER than Jan 31. They can send them any time before that if they want, and most do.

-

January 9, 2021 at 2:23 pm #4443674Shelley

I fall into this category, and they act like we have the option to just file our tax returns now. By law, employers have until the last day in January to even MAIL W-2 forms, which means many won’t be able to file until sometime in February. There may be nothing we can do about this, but at the very least we deserve an answer. I used TaxAct and got the last stimulus direct deposited on time, no problem.

-

January 9, 2021 at 1:21 pm #4443661Waiting every year

Did anyone NOT get their full amount?

My husband and I were apart of the different account fiasco, we ended up getting a DD yesterday from TT…but both my kids were left out. Gosh it’s so frustrating. Also, I assume even though we can claim this as a rebate credit on our tax return – IRS will take it to pay back any taxes owed which we will owe this year, I’m certain of that. -

January 9, 2021 at 12:51 pm #4443655Mj

Has anyone not submitted 2019 taxes….but received the first stimulus. On the IRS site received I see the #2 notice no information on file….

Are you in the same situation,Yet still received the second stimulus?I received the first relief by mail so I’m not if I have to wait again or do ahead and do taxes I don’t want to delay things.

-

January 9, 2021 at 11:03 am #4443636Ian

Wells Fargo TT Fees got DD after midnight local time.

-

January 9, 2021 at 1:28 am #4443570Wicked

Liberty Tax is now working with IRS to return funds and will get them out accordingly either direct deposit or by Check supposedly they are waiting on IRS so fingers crossed by Monday we here better news! 🤞

-

January 8, 2021 at 11:33 pm #4443541Shannon Herndon

I haven’t received the first stimulus

-

January 8, 2021 at 11:18 pm #4443540MrCrisp023

Got mine DD at around 3pm. Site still shows unavailable. It’s coming y’all.

-

January 8, 2021 at 8:48 pm #4443475NoMoney

Filed TT. Got email at 1:30am from TT saying I’ll get my refund, WMP website shows the Payment #2 not available message, got my DD at 4:00 pm. Credit unions only post payments at certain times, but if you got an email from TT, you WILL get your refund..

-

January 8, 2021 at 7:08 pm #4443414Nancy

My GMP says not enough info/not eligible, received my deposit this evening at 5pm to my account.

-

January 8, 2021 at 7:03 pm #4443409Buttercup

I received my Stimulus at 5:45pm. Filed TT, had fees taken out, Netspend card, I live in South Carolina, also received both emails.

-

January 8, 2021 at 5:57 pm #4443312SunShine

Jackson Hewitt, Tax Act, and Liberty are still giving the same lame excuses. This is unacceptable! If TT and HR Block can release the money so can they. Use social media, the news, or whatever means you have to put pressure on them. Bills are not stopping until late Feb/March to be paid with a tax credit. Don’t fall for this they can do something to get us our money.

-

January 8, 2021 at 5:28 pm #4443268Dior

Has anyone who went to liberty tax received there’s? Or Netspend?

-

January 8, 2021 at 5:08 pm #4443250

Chime user. Just received DD. Was affected by TT fees. IRS status stil not available.

-

January 8, 2021 at 4:58 pm #4443246Cbeejb

Anyone from Missouri get there’s yet

-

January 8, 2021 at 4:30 pm #4443213

@gummi did you use TT?

-

January 8, 2021 at 4:13 pm #4443179Gummi

Just received my Stimulus!! Chime user.

-

January 8, 2021 at 4:08 pm #4443173Melissa

Has anyone filed with TurboTax with no fees taken out, GMP payment not available and received DD?

-

January 8, 2021 at 4:07 pm #4443171Come on stimulus

Credit union just updated and my stimmy is there! Gods hand over all of you and especially those waiting – don’t worry He has a plan for His children.

Have a great weekend and we will see everyone in February!

-

January 8, 2021 at 4:04 pm #4443164Ashley Johnson

Anyone file with Republic Bank because all they say is file on your taxes. I don’t understand how turbo and h_r block reissuing checks but not them. Every one should follow thw same procedures

-

January 8, 2021 at 3:58 pm #4443156

Hey guys! I filed with a private tax prep. Got the 1st stimulus, no issues. I have the stimulus #2 message :( but my transcripts give a 1/4 deposit day 20205302 cycle & 846 code. Banking with Wells Fargo. Is there any hope for me yet? Appreciate you all and hope that we all find answers and get that stimulus soon!

-

January 8, 2021 at 3:48 pm #4443146Buttercup

I filed with TurboTax, I received both emails. My mom and sister both filed with Turbo and had fees taken out and they received their stimulus no problem before the 4th. I’m not sure why we are going through this. I haven’t received a direct deposit yet I stay in South Carolina, I’m hoping that they are sending this money, I have an eviction letter for the 19th to leave if I don’t pay 1184, this would help me a lot.

-

January 8, 2021 at 3:42 pm #4443142Lisa S Borders

I received mine today, Had No information showing for Stimulus 2. I am with BoA.

-

January 8, 2021 at 3:34 pm #4443135midwestguy

Received mine around 1:30. I bank with SIMPLE.

Had payment Status #2. Went through TT. Received from SBTPG.

-

January 8, 2021 at 3:15 pm #4443111Cbeejb

Got the email 1am ct but haven’t received my stimulus yet here in Missouri also as anyone received it with community America credit union

-

January 8, 2021 at 3:14 pm #4443109Ian

Turbo Tax, Wells Fargo here. IRS says Not Avail nothing yet.

-

January 8, 2021 at 3:02 pm #4443102Justin

Mine hit netspend at roughly 2:00 ET. Hopefully they get them out to everyone today. Good luck everyone. See you all again in February.

-

January 8, 2021 at 2:52 pm #4443094

I was told that my stimulus payment was sent to SBTPG… did anyone hear this and when will they be sending the payment back to the taxpayers??

-

January 8, 2021 at 2:45 pm #4443077NoMoney

I’m a credit union too.. no deposit, but my bank only post payments at 1am and 4

-

January 8, 2021 at 2:33 pm #4443059

Still waiting…… Filed with freetaxusa….transcript says 1/4/21 deposit….GMP says Not Available….bank with Varo…

-

January 8, 2021 at 2:19 pm #4443044

NY here part of the city Credit Union . Nothing .

-

January 8, 2021 at 2:16 pm #4443042

New York, my father just recieved his through local credit union. Me and bf both waiting with other seperate local credit unions. Will post when we recieve

-

January 8, 2021 at 2:05 pm #4443027Come on stimulus

I’m a credit union member here in California and still no deposit just yet…

-

January 8, 2021 at 2:03 pm #4443026

Just received mine today it’s really coming look out for it.

All-Access: $1,059.85 available after $1,200.00 Direct Deposit from TAX PRODUCTS PR1 on 01/08/2021 12:26:02

-

January 8, 2021 at 1:51 pm #4442998Deana

I finally got my stimulus. Got the email from tt this morning about it being released and just got my payment at 1:15. Everyone keep faith it is coming

-

January 8, 2021 at 1:48 pm #4442991Gummi

My friend who has Bank of America just received hers here in California.

I’m a chime user and nothing just yet

-

January 8, 2021 at 1:48 pm #4442992Gummi

My friend who has Bank of America just received hers here in California.

I’m a chime user and nothing just yet

-

January 8, 2021 at 1:42 pm #4442973

I have used TT for years and the last 5 days have sucked. I have gotten both Email from TT about the issue. This morning gave me some hope. 20 min ago I got notification from Huntington Bank that I have a pending deposit from Tax Products!!!!

-

January 8, 2021 at 1:41 pm #4442971

Had the same message. Netspend sent an email deposit is posting. Freetaxusa DD 1/4 Good luck and see everyone in a few weeks!

-

January 8, 2021 at 1:35 pm #4442948Blessed

Good Afternoon Everyone,

I’ve been following this thread so I wanted to post an update.

Filed with a tax prepared (not H&R Block or Turbo Tax) for 2019 – fees to be deducted from refund.

Checked IRS website to track stimulus payment – Not Available.

2020 tax Transcript has 846 DD 01/04

I just received direct deposit from SBTPG within the last half hour.

FL – SunTrust**There really is hope. I hope everyone else sees a deposit soon :)

-

January 8, 2021 at 1:21 pm #4442918Tate

I filed with turbo tax and got both emails if that matters!! But the wait and fuckery is over. Again I have Netspend

-

January 8, 2021 at 1:20 pm #4442915Tate

I just got mine and I have Netspend!! Hang in there everyone

-

January 8, 2021 at 1:16 pm #4442910V

What if you filed with other prepared (like expresstaxrefund) but went through SBBT also – I am still waiting for my stimmy :(

-

January 8, 2021 at 1:12 pm #4442900Lexie

Ken

Who did you file with?

It depends on who you filled with bc I filed Jackson Hewitt and they aren’t helping their customers to get there money quick they just told us to file it on our 2020 taxes -

January 8, 2021 at 1:02 pm #4442871Ken

I just wanted to let everyone know my IRS “Wheres my stimulus” tracker says Payment status 2 – not available.

I just got my full stimulus as of 20 minutes ago. Don’t lose hope – it may still be coming even though they are saying otherwise.

-

January 8, 2021 at 12:54 pm #4442861TT

T

-

January 8, 2021 at 12:53 pm #4442859Lexie

Come on stimulus

Thank you for all your help and believe me I plan on never filing with them idiots again!

-

January 8, 2021 at 12:28 pm #4442801NoMoney

So I checked email again. I apparently got an email at 1:30am EST last night/early this morning. It went to my junk mail for some reason. It’s odd because i have been with TT for years and I get emails from them every year. My email says the same thing.

-

January 8, 2021 at 12:24 pm #4442796Come on stimulus

@Lexie – forgot to add. It’s ridiculous that Jackson Hewitt is urging their customers to make an appointment with them to file and claim the stimulus on their returns instead of finding a solution to get the money now. They are abusing and capitalizing on customers misfortunes. Probably not the best customer service practice- if I were a customer of Jackson Hewitt, I would run and never look back!

-

January 8, 2021 at 12:19 pm #4442785Come on stimulus

This is the most recent JH statement I could find:

Remember, squeaky wheel gets the grease!

I would suggest calling and requesting to speak with a branch leader and urging them to adopt the Turbo Tax model in getting stimulus payments to the customers. -

January 8, 2021 at 12:02 pm #4442761Come on stimulus

Just talked to my sister in SC. Her and I both TT and received emails indicating payment was on the way…. she just got hers directly deposited she said.

-

January 8, 2021 at 12:02 pm #4442760Lexie

Come on stimulus

Thank you! I’ve been searching the web calling everyone and they are all just telling me BS info

-

January 8, 2021 at 11:57 am #4442752Come on stimulus

@Lexie

People with Turbo Tax. I haven’t yet read anything on Jackson Hewitt but I can’t imagine that JH won’t utilize the same model as TT if they don’t want to lose their customer base… I will research and repost if I hear anything about JH.

-

January 8, 2021 at 11:52 am #4442747Lexie

Come on stimulus

Does that mean for everyone or just the people that filed with TT bc I filed with Jackson Hewitt and they aren’t doing anything to help

-

January 8, 2021 at 11:48 am #4442737Come on stimulus

“We are happy to share that stimulus payments for those impacted by an IRS error will begin to be deposited starting January 8th. We expect most payments to be available that day, but your bank could take a few business days to process. Your payment will be deposited into the same bank account where you received your 2019 tax refund.

We have been working tirelessly with the Treasury and IRS.

This update may not immediately be reflected in the IRS Get My Payment tool.” -

January 8, 2021 at 11:41 am #4442729Come on stimulus

Sometimes reps at any level of government will only share with you what their managers share with them. Those managers get their information from the publications of the agency. Since IRS has not updated their publication since TT released their statement and recent emails, IRS agents are only going to regurgitate from their own sources. Therefore, I wouldn’t put too much stock into what many of them say. Just my thoughts…

-

January 8, 2021 at 11:36 am #4442724Lexie

I just got off the phone with a Jackson Hewitt rep and she said that the irs sent them a email saying that they are not issuing any money a second time that if you was one of those people that your money was sent to a wrong account you will have to claim it on your taxes which is BS! They need to fix their fuck up!

-

January 8, 2021 at 11:22 am #4442715morfessisnt

I just got off the phone with the IRS and the information that they provided is contradictory to the email that TurboTax sent out this morning. According to the IRS, TurboTax has agreed to send the money back to them and then those people will have to file for their rebate on their taxes.

-

January 8, 2021 at 11:22 am #4442713Gummi

@Lexie did you talk to an actual IRS agent that could look into your tax account or just EIP department? I spoke to actual agents that could tell me what account number they showed and it was the last 4 of my social meaning it went to the third party bank. They said since it would be returned to them that I would be issued a check. That was until TurboTax decided they didn’t want to lose their customers lol

-

January 8, 2021 at 11:18 am #4442710Lexie

Gummi

Thank you for your reply I have talked to the irs she said there was no further info on the situation at that time I called yesterday around 12 noon and I called Jackson Hewitt and the lady said the same thing as the irs I hate that they are keeping everyone in the dark about it all like the lease you can do is keep us updated

-

January 8, 2021 at 11:11 am #4442703Lexie

Does anyone here by any chance use bluebird card? An knows any information about the stimulus or when it’s going to hit our card

-

January 8, 2021 at 11:10 am #4442700Gummi

@Lexie I’m so sorry to hear that. Did you try calling an IRS agent. Their protocol (from what I was told 2 days in a row) if the payment is rejected they will send you a check. The 15th date doesn’t pertain to those who show a direct deposit date whose money was sent to a closed third party account because you were actually sent a payment. Again, this was IRS agents on my personal account and I used TurboTax. Hope that information helps.

-

January 8, 2021 at 11:06 am #4442699Lexie

I have Jackson Hewitt and they aren’t doing jack crap to help their customers I’ve been going to them for 5! Years!! All they keep saying to us is to file it on our 2020 taxes!! Yeah I’m gonna file my foot right up their a** is what I’m gonna do! I’m beyond agervated 🤦♀️

-

January 8, 2021 at 10:25 am #4442670Gummi

@Scott I haven’t received mine yet either but received their email. Greendot users started to receive theirs yesterday without the email. This affected millions of people. I know it’s hard to wait but hopefully we’ll all receive them today through to Monday. 😁

-

January 8, 2021 at 9:34 am #4442648Scott

Mine shows the Payment Status #2-Not Available but I received an email last night from TT saying that my payment was now on the way and that customers impacted (like myself I would assume) would be getting theirs today 1/8/21. I just checked my bank account and still nothing. Was this simply one last ploy to get me to believe that I would be getting mine? Will never use TT again because of this and was a 10 year customer.

-

January 8, 2021 at 8:55 am #4442600

I got the same message. I got my first dd fine as well. So are we just screwed?

-

January 8, 2021 at 8:55 am #4442598Conway Twitty\\\\\\\’s illegitimate child

How do I know if I’m supposed to receive a stimulus payment that TurboTax is processing as a result of the IRS error?

If you didn’t receive an email confirming that your stimulus payment is on the way, we may not have enough information to process a payment for you. However, we are still working with the IRS and Treasury to find an alternative way to deliver your stimulus payment.This is listed on the FAQ section of TT

-

January 8, 2021 at 8:52 am #4442594

TT folks…I too received this email at 11:20 CST last night:

Great news, your stimulus payment is on the way!

We are happy to share that stimulus payments will begin to be deposited starting January 8th. We expect most payments to be available that day, but your bank could take a few business days to process. Your payment will be deposited into the same bank account that you received your 2019 tax refund.

Here’s to hoping!

Cheers

-

January 8, 2021 at 8:20 am #4442570NoMoney

@mama char

I filed the exact same way. I got my refund the first time just fine, but I still haven’t received any email from TT? Did you get a refund? -

January 8, 2021 at 8:15 am #4442566NoMoney

I have read the statements by the IRS about Payment #2 no status update, HOWEVER, it never actually says why we are receiving that message. It says the DD’s that were sent to incorrect accounts , have a partial account number. So why are we really seeing it. I got DD FINE last time???

-

January 8, 2021 at 8:10 am #4442563NoMoney

@ come on stimulus

Did you have the Paynent#2 no stays available? -

January 8, 2021 at 7:54 am #4442555William

No emails yet. Not sure what to think. I use netspend so depending how long after u get the email u get dd i usually get dd a few days before the actually date they send so i may not see an email until after my dd

-

January 8, 2021 at 7:53 am #4442554Lisa

Hey guys .did anybody else use e file like my tax preparer did ? I haven’t got my stimulus yet I have Bank of America

-

January 8, 2021 at 7:32 am #4442546FLGirl

@waitinggame2020

Very true! WIth so many people affected – I am trying my hardest to be patient and not get upset! I will say – I have always used Turbo Tax and will continue to use Turbo Tax – whether I receive my second stimmy or not. Plus they are fixing or trying to anyways to make it possible for some to receive their money. -

January 8, 2021 at 7:31 am #4442545Gummi

Hello everyone,

CA- Chime user- Received all TurboTax emails

Came here from a different forum to try and assist. We’ve been on here for a few days now figuring things out and giving information as we receive it. Yesterday all Green Dot users seemed to have gotten their direct deposits. This mess affected a lot of people so don’t worry the payments are coming. 😁 I’ll update when I receive mine as well.

-

January 8, 2021 at 7:22 am #4442540Waitinggame2020

Keep in mind all they guesstimated this time to have affected 15 to 20 million people. With that being said as much as we do not want to give them a minute to figure it out their internal servers might not be able to process out 20 million emails simultaneously. As well you might be getting thr email as the irs gets verification to the tax company they processed accordingly.

-

January 8, 2021 at 7:20 am #4442538FLGirl

@Chloe – Thank you – I was switching forums to make sure everyone has all the info on TT.

-

January 8, 2021 at 7:08 am #4442530

Hey there IGMR Administrator asked us to to come help some other threads. Please visit this link. But to be clear, many of those who had payment sent to a closed account due to fees will get their refund, including those with no status messages on GMP

https://www.wcvb.com/article/rossen-reports-irs-announces-new-rules-to-get-stimulus-money/35154228

-

January 8, 2021 at 6:22 am #4442493

Free tax usa

-

January 8, 2021 at 4:27 am #4442475Jae

@Jamis

Who did you use to to file your 2018 with?

-

January 8, 2021 at 3:35 am #4442368ConfusedDiego

Hello,

I filed taxes with freetaxusa and no fees were paid from my refund. Actually I didn’t pay any fees nor did I receive a refund.

I received the first stimulus direct deposit no issues. But my second stimulus was put into wrong account.

The second stimulus says code 766 tax relief credit 01-18-2021

868 refund issued 01-04-2021

971 notice issued 05-11-2021

cant get thru to irs and freetaxusa said they haven’t received anythinganyone have any insight thank you

-

January 8, 2021 at 3:35 am #4442444Alicia

Check sent to a closed account will it be mailed

-

January 8, 2021 at 2:52 am #4442436Laura

From my understanding you won’t receive it, unless you file recovery rebate unless yours went To wrong account or a card through Torino tax that’s not valid. If it shows payment status not available you will have to file recovery rebate, here’s the catch until they’re done releasing funds on the 15th you can’t even file for the recovery rebate I tried already!! So not only do you not get your money ASAP you can’t even file till the 15th to add rebate!!

-

January 8, 2021 at 2:32 am #4442434SunShine

We need to keep our feet on the necks of Liberty, Tax Act, and Jackson Hewitt. They chose to send our payments back to the IRS when they could’ve made arrangements like HR Block to send them out. We need to bring more attention to them like TT customers did. Lets put the heat to their a** so that they will pay up. Late Feb/March is a LONG time to wait for a tax credit. The grocery store, bill collectors, and the landlord is not going to wait to get paid in tax credits.

-

January 8, 2021 at 1:55 am #4442415Janis

I received first stimulus no problem because they used 2018 taxes, this time I got nothing. I don’t work anymore so therefore I can not file 2019 taxes. I’m on disability now. Where do I go from here it’s very frustrating because I can’t talk to anyone to tell them my situation. Does anyone have a solution to this.

-

January 8, 2021 at 1:01 am #4442380Jae

@ come on stimulus

Thanks….Good luck!!!!!

-

January 8, 2021 at 1:00 am #4442379Come on stimulus

My WMP still says Payment #2 not available but I received the TurboTax email… I’m gonna start checking my account tonight and will keep you posted if it comes through

-

January 8, 2021 at 12:58 am #4442378Come on stimulus

@Jae

It was just emailed to me at 9:30pm California time.

My WMP stills and Payment #2 Not available.

-

January 8, 2021 at 12:55 am #4442375Jae

@come on stimulus

When did you receive that??

-

January 8, 2021 at 12:51 am #4442373Come on stimulus

Dear Valued TurboTax Customer,

Great news, your stimulus payment is on the way!

We are happy to share that stimulus payments will begin to be deposited starting January 8th. We expect most payments to be available that day, but your bank could take a few business days to process. Your payment will be deposited into the same bank account that you received your 2019 tax refund.

-

January 8, 2021 at 12:41 am #4442364

After everything got messed up my stimulus wasn’t deposited on my tt card. I was finally able to see an update on the irs portal saying they has scheduled my check to be mailed on the 6th to the address they have on file. Im not able to use the tracking thing through the postal service and still haven’t been able to actually talk to a real person to make sure thats correct. Is anyone else getting a checked mailed or know how long it will take to be delivered.

-

January 8, 2021 at 12:13 am #4442354

I have the Payment Status #2 message on the Get My Payment tool. I filed with TaxAct for my taxes and Payment 1 shows correct deposit account on GMP as I have used the same acct for years. Should I assume I will not be getting the stimulus and to just claim the rebate whenever I do my taxes.

-

January 7, 2021 at 8:28 pm #4442220GizmoSmurfer

Agreed Big D McGee! AGEED! The damn bastards!

-

January 7, 2021 at 6:12 pm #4442153Big D McGee

This is it Hell with Taxact and Republic Bank, people you can do your own taxes free thru irs.com and have a straight routing number with irs, so this shit does not happen again.

-

January 7, 2021 at 5:34 pm #4442112

I can’t find the post , but someone said Tax Act is.now trying to get us our.monry?

This is from their website: https://blog.taxact.com/second-stimulus-payment-is-happening/

I really hope they get it resolved. I need the $ now, not in late February/early March

-

January 7, 2021 at 5:14 pm #4442087MamaChar

Has anyone with the Unavailable payment status that filed with TT and had fees deducted, and showed a 01/18 date on their transcript received a deposit?

-

January 7, 2021 at 4:29 pm #4442007AERO

fee tt charges you to file

-

January 7, 2021 at 4:26 pm #4442003

Completely STUPID question, but what does everyone mean when they say they had their “fees” taken out of the filings with TT? Is that the fee they charge to file, or does this mean monies you owed on your Federal Taxes?

-

January 7, 2021 at 4:04 pm #4441980Kp

I can’t find the post , but someone said Tax Act is.now trying to get us our.monry?

-

January 7, 2021 at 3:59 pm #4441977

How do you know if your payment went to Republic Bank or not? Use TT, but requested DD. No problem with first stimulus check. #2 says unavailable. Is there a way to check somewhere online to see if it was returned or if i’ll end up having to file on my taxes.

-

January 7, 2021 at 3:51 pm #4441966Dianna*ohio

Mine shows #2paymemt unknown , either not enough info, or not eligable. I used direct deposit and did turbk tax. TurBo tax sent out emails stating theyd redirect moneys, ect, but does that only apply to those who show money recived but to wrong accounts? If so then im screwed till taxes. Being a out of work, single mom, soul Provider of 4 kids, no unemployment, welafre , or child support receiver this is horrible news.

-

January 7, 2021 at 3:51 pm #4441964June

People are blaming turbo tax but its not their fault its the IRS fault

-

January 7, 2021 at 3:46 pm #4441956

@JD.

I have used TaxAct for 20 years, and we had the same issue, only TaxAct wasn’t going to do anything and just let everyone file for it. This afternoon they finally changed their tune and said they were going to work on getting us our money. The issue lies in having fees taken out of the refund.

-

January 7, 2021 at 3:20 pm #4441935Lexie

Ben W

You may have your money tomorrow if it says the 8th hopefully you do!

-

January 7, 2021 at 3:16 pm #4441934Lexie

COC2019

I hope you get it on the 18 🤞 and I’ve heard that H&R Block and TurboTax are trying to get the money from those accounts and send them to the real account I have Jackson Hewitt so they just told me that I have to file it on the 2020 taxes which sucks

-

January 7, 2021 at 3:08 pm #4441924Awesomecows02

@JD

Exactly what mine says. Filed with Turbo for 2019. First time doing it and it will be the last. Will be going back to using taxact again. I called republic bank and my payment got returned to the irs, due to the temporary bank account being closed. I hope we get some kind of solid statements about what is going on. Yesterday morning, I called several Senators offices about this issue. -

January 7, 2021 at 3:02 pm #4441915DConway39

Freaking awesome. …. I’ll get mine at the end of March.. Unreal

-

January 7, 2021 at 2:54 pm #4441905

I filled using Tax Slayer. Does anyone know if the stimulus payment issues with Tax Slayer are like those with Turbo Tax? My transcripts stated that Refund was issued 1-4-21 and credit to account 1-8-21.

Thanks in advance for the insight.

-

January 7, 2021 at 2:44 pm #4441878

My Transcript page shows this information in this order (I didn’t display the amount I’m receiving and some other numbers, but I did include my cycle number):

766 Tax relief credit – 01-18-2021 -$(amount)

766 Credit to your account – 01-18-2021 -$(amount)

846 Refund issued – 01-04-2021 $(amount)

290 Additional tax assessed x-x-x-x – 20205302 (cycle) – 01-18-2021 – $0.00So is this what most people are seeing who’ve been affected by the screw up?

-

January 7, 2021 at 2:43 pm #4441877

So does your refund page only have to show “#2 Status Not Available”? My “Get My Payment” page shows:

Payment #2 Status – Not Available

We are unable to provide the status of your payment right now because:

We don’t have enough information yet (we’re working on this), or

You’re not eligible for a payment. -

January 7, 2021 at 2:09 pm #4441834William

@FLgrl

yeah doing tax season…wont happen

-

January 7, 2021 at 1:33 pm #4441801FLGirl

@william

We can hope! Does look very likely we will get the 2k as well, well 2k less the 600. Love to see how that one goes!!!! Lol. -

January 7, 2021 at 1:21 pm #4441786William

Nice. i lived here almost 2 years now.

hopefully they get it together and send it

-

January 7, 2021 at 1:16 pm #4441778FLGirl

I bank with Wells Fargo as well. People are getting theirs though who used TurboTax have the 1/4 date on the transcript and their status our in GMP at IRS still states unavailable and they got their DD 2 hours ago

-

January 7, 2021 at 1:15 pm #4441776FLGirl

Moved almost 2 years ago from Clearwater, over in St Lucie County now.

I have not gotten mine yet either. I did use TurboTax to file, had my fee come out. As I understand it Turbo is working with Treasury and IRS to get payments to the corrwct accounts.

-

January 7, 2021 at 1:06 pm #4441769

@FLGirl

I used TT but I live in Wisconsin, the site has not changed for me, can not get transcript, called bank no info for me and I did receive the first stimulus check. It’s like I got lost in the system shen it came time for the second round. I can not get any answers from no one. I also checked to see where you can file the stimulus credit and I only see credits for self-employed people.

-

January 7, 2021 at 1:01 pm #4441759William

@flgrl

where at in fl? im in clearwater.

i didnt get the email yet and used tt

-

January 7, 2021 at 12:57 pm #4441751FLGirl

Not sure if anyone reads any other boards. I got an email from Turbo Tax last night. Alot of people who used Turbo are getting their DD, I have seen a lot get theirs today and the IRS tool still states not avaliable for them.

-

January 7, 2021 at 12:54 pm #4441747William

called republic bank again and they havnt received any money for me. what does that mean?

-

January 7, 2021 at 12:51 pm #4441745

Correction:

Thanks @Lexie

Just called and they have NO information for me.

-

January 7, 2021 at 12:28 pm #4441711

Thanks @Lexie

Just called and they have information for me.

-

January 7, 2021 at 12:21 pm #4441704

Has anyone with BB&T received their payments? Yes, I used TT with a direct deposit. Status says not available with the IRS. Transcript shows 1/4 and 1/18 dates. I’m seeing so many different responses on here, it’s becoming confusing. Is the IRS still processing DD’s, or if you don’t have it by now, you’re not getting it?

-

January 7, 2021 at 12:08 pm #4441689COC2019

Tiffany

What status?

-

January 7, 2021 at 12:03 pm #4441685Tiffany

Mine has this status and I just received my DD from Turbotax

-

January 7, 2021 at 12:03 pm #4441684COC2019

Lexie

The my payment tool doesn’t hace an update. It says no information available. I got this info from my actual IRS transcripts. I wasn’t sure if that men’s I’ll get it on the 18th.

-

January 7, 2021 at 11:52 am #4441662Lexie

William

Me either the first time it went in the next day after they released them hopefully you get yours 🤞 and hopefully they fix mine 😞

-

January 7, 2021 at 11:51 am #4441658Lexie

COC2019

You may get it on that date I’m not sure I have no date mine just said unavailable bc they sent mine to a closed account 🤦♀️

-

January 7, 2021 at 11:50 am #4441656Lexie

Wisconsin2010

This is the number I called 1 (888) 782-3333

-

January 7, 2021 at 11:22 am #4441608COC2019

My IRS transcripts said my payment was sent on 1-4-21 but then it has a date of 1-18-21. Does anyone know what this means?

-

January 7, 2021 at 10:28 am #4441534

@lexie

@williamI had no problems last time either and when i called they said they have no information for me. Is the number 1(888)584-3600?maybe im calling the wrong number

-

January 7, 2021 at 10:27 am #4441533Big D McGee

F*ck them all storm the halls again do it right this time iam over irs dems reps over it all

-

January 7, 2021 at 10:17 am #4441507William

@lexie

hopefully dd i have no info on anything. im reading everything people r saying. I had no problem with dd last time. so who knows.

-

January 7, 2021 at 10:00 am #4441477Lexie

William, then I would say you should be getting yours either direct deposit before the 15th or check check in the mail or a debit card in the mail

-

January 7, 2021 at 9:44 am #4441452William

i called and republic said that they did not receive a payment. So what does that mean?

-

January 7, 2021 at 9:41 am #4441451Tate

So I have no idea what TT is talking about. I told them about the email from TT and they were like we haven’t been told how to really handle the issue about the payments. I told I figure led because right never knows what left is doing and I can’t believe the IRS would really make people who need it suffer more

-

January 7, 2021 at 9:40 am #4441450Tate

I was told by the rep that it would be our 2020 taxes and I told him that’s not right but her said because we are in a new tax year that’s why they are doing it that way. Honestly they haven’t even been given proper directions on how to handle this issue they caused.

-

January 7, 2021 at 9:40 am #4441448Lexie

If anyone wants to find out if your money was sent to a closed account call republic bank and click the option of taxpayers then I’ll ask you about the economic payment then you put in your social and I’ll let you know if your money was sent to a close bank account because I just done it in mine was sent to a close bank account so the bank sent my money back to the IRS

-

January 7, 2021 at 9:38 am #4441446Tate

So I just got off the phone with the IRS and I was told that for those who were affected by this IRS error we will need to file our taxes in order to receive what’s owed to us. They will not be reissuing the money again.

-

January 7, 2021 at 9:30 am #4441431

@Tate, so when we go to file 2020 that will determine how much we get? I thought it was still based on 2019. I am confused sorry

-

January 7, 2021 at 9:28 am #4441429

No problems with the first round and i get that the account may be closed. What i do not understand is that i read articles saying they were prepared and this sure does not look that way to me.

-

January 7, 2021 at 9:26 am #4441425Tate

Then apologies came in liked that was supposed to ease the pain of millions of people that actually really really need it. So if you hear something different good for you but I know what I was told. Also they are using 2020 taxes to calculate the second stimulus for the people who did not get one yet.

-

January 7, 2021 at 9:20 am #4441412I_want_my_money

So when does these Letters/Notices suppose to go out? and no where on the last letter did it say to keep until 2021 filing season. I still have it because I am one of those people that as soon as i get rid of somthing everything goes wrong.

-

January 7, 2021 at 8:29 am #4441368Lexie

Bc those accounts are no longer open because the tax season ended and those accounts are gone so when you file taxes this year they open new accounts and link them to your account so it’s pretty much like a dummy account for each year when you file taxes

-

January 7, 2021 at 8:27 am #4441363Lexie

For everyone wondering why the first went through with no problems is because when you filed with Jackson Hewitt H&R Block and TurboTax they create an account and a link that account to your actual account well at that time and the first stimulus was sent that account they created was still open but after tax season they closed that account and it does not open again till tax season so the IRS sent our stimulus to those accounts they bounced back

-

January 7, 2021 at 8:27 am #4441362

I got an email from Turbo Tax saying they are working “tirelessly” with the IRS to resolve this issue….but my GMP still says”not available”. I am not sure if mine was sent to a wrong account or not, but the email showed up late last night. Who knows? Again, a giant clusterfuck.

-

January 7, 2021 at 8:23 am #4441355Lexie

So now since they screwed up we have to wait and claim our missing money on our 2020 taxes which is BS to me I’ve tried to contact irs I got ahold of someone and asked them about the situation and they said no comment and directed the phone call to a number that was disconnected 😡

-

January 7, 2021 at 8:21 am #4441352Lexie

I’m in the same boat apparently JH H&r an TT open accounts when we filed taxes that was linked to our actual accounts and those accounts are now closed but the are still linked to our actual accounts so when the irs sent it to those accounts the money bounced back bc they are no longer active

-

January 7, 2021 at 7:31 am #4441288Michelle

I received payment Monday check being deposit to and account which is the last 4 digits of SS# and now status says payment status unavailable…why

-

January 7, 2021 at 4:22 am #4441221

I get the same message. Funny thing tho, I am a SSDI recipient so now I am supposed to file taxes to get my stimulus payment? I got the first one DD, no problem. So now what!? Anyone else in my predicament?

-

January 7, 2021 at 2:24 am #4441218FkdNvirginia

Thanks TURBO TAX and you crazy fucks sitting all high and mighty up in the irs

Got wait to get 2nd stim 1st went thru fine -

January 6, 2021 at 9:40 pm #4441097Becca

@pissed the exact same thing is happening to me. I wonder what we should do.

-

January 6, 2021 at 9:36 pm #4441094Becca

I am getting this same message. However, I checked my transcript and it says refund issued with an 846 next to it and a date which is 01-04-2020. Money hasn’t been deposited into my bank account ( which is the same one I’ve had for years) so it’s the one the IRS has on file. Does this mean my money got deposited somewhere else? Please advise! Thank you

-

January 6, 2021 at 9:20 pm #4441082Adama

I don’t get it I had my first stimulus sent to me by check and then I checked today and it’s sent to a bank account . I don’t have any open bank accounts open atm . Wtf

-

January 6, 2021 at 8:37 pm #4441066Betty

My second stimulus was sent to a closed bank account and the bank rejected it will I receive a paper check?

-

January 6, 2021 at 8:33 pm #4441065

We have been working tirelessly on a solution with the Treasury and the IRS. As a result, our expectation now is that within days the error will be corrected and stimulus payments will begin being deposited into the correct bank accounts.

thats per TT twitter 5 hours ago

-

January 6, 2021 at 6:44 pm #4441030Xmf45

Hello.

I am having some difficulty understanding the recovery rebate credit for 2020. I was filed as a dependent in 2019(did not receive either stimulus checks).This year I have been filed as an independent. I’ve seen that the recovery rebate credit lowers your federal(?) taxes; however my agi is below the 12,400$ amount to pay federal taxes. How would I receive this recovery rebate credit? Will this be something I can use to purchase food for myself and how much should I expect? -

January 6, 2021 at 5:11 pm #4440975Stephanie

I dont get it my fiance has the same bank account and did direct deposit for his 2019 taxes and got his first stimulus with no promblem i checked this moring said information wasnt correct on file then i checked back and say need more information how is this shit possible i got a check and its saying the same thing not enough information this is bullshit we are all struggling they should still give everyone the 600 even after the 15 of January

-

January 6, 2021 at 3:06 pm #4440911BB

I never got a 846 on my transcripts. It shows a 290 along with a cycle code and date of 1/18/21. Does this mean that it hasn’t been sent or processed yet? I do get the “status not available” I did go through TT and had my fees taken out. On my transcripts for the first stimulus it has my correct bank info. Any insight? Thanks.

-

January 6, 2021 at 2:59 pm #4440902Awesomecows02

I’ve been calling senators offices all morning. This wont fly. I actually got to speak to a human in Senator Sanders office.

-

January 6, 2021 at 2:41 pm #4440896

-

January 6, 2021 at 2:33 pm #4440886Lori

@pissed thats the same here it said the 4th but nothingnow it says no payment info

-

January 6, 2021 at 12:29 pm #4440800Awesomecows02

What will stop the IRS from garnishing our stimulus check for back taxes, now that we have to claim it on our taxes? Well no check for me means my family is really is screwed. Thanks IRS.

-

January 6, 2021 at 12:19 pm #4440789

This isn’t affected by what you owe. This means that they tried sending it to wherever your tax preparer had it sent and the place rejected it and sent it back. Now they won’t issue a check and they are saying people will have to wait which is a bunch of crap

-

January 6, 2021 at 11:57 am #4440757

@crgray I have the same 290 0.00 amount on my transcript. Do you owe taxes or have a payment plan with the IRS? I have an installment plan and I’m thinking this is the reason I’m having the issue with the stimulus.

We do. However, I thought that this payment wasn’t supposed to be affected by that.

-

January 6, 2021 at 11:24 am #4440738JR

@crgray I have the same 290 0.00 amount on my transcript. Do you owe taxes or have a payment plan with the IRS? I have an installment plan and I’m thinking this is the reason I’m having the issue with the stimulus.

-

January 6, 2021 at 11:20 am #4440735pissed

We did our own taxes, no problem with first stimulus. Second stimulus shows on transcripts that it was sent 01/04. Still nothing but when I check on the wheres my payment, it shows that Status not available. Should I just wait it out???? IRS wont accept calls right now.

-

January 6, 2021 at 11:11 am #4440725StephanieB

So those of you who have called TT and they told you that you will receive a paper check…. what does the GMP tool say when you check it?

-

January 6, 2021 at 11:00 am #4440720

This is horse shit

-

January 6, 2021 at 10:45 am #4440702Egghead

I used TT also. Still nothing!

-

January 6, 2021 at 10:34 am #4440693

Here’s what I don’t get: I filed jointly with my husband, and my transcript shows what I assume to be the stimulus payments, both with a 290 code and $0.00 amounts on both. We got the first payment, GMP shows our bank account. Yet apparently our second payment was sent to Republic and sent back. What is going on?!

-

January 6, 2021 at 10:31 am #4440690

I used TT as I always have for the past 7/8 years and had fees taken out. I got the first stimulus without error or delay. I haven’t received the second and GMP tool says Not available.

My transcripts say 846 1/4/2020 and have the amount. So I am very confused. ANYONE HAVE ANY IDEA what is going on?

None of us seems to know other than what the IRS website told us as of this morning. This sure seems to be by design.

-

January 6, 2021 at 10:19 am #4440674AleciaS

My husband and I file jointly with 2 dependents. With his information plugged into the Get My Payment tool I get the ‘no information’ status. With my information put in I get a message that states a check is scheduled to be mailed on 1/6. How is this possible?

-

January 6, 2021 at 9:59 am #4440663StephanieB

How are we supposed to claim it on taxes if our transcripts are showing 846 1/4/2020? Mine show I got a deposit and didn’t. Besides that I had a dependent on 2019 taxes that I won’t have on 2020. With all this craziness we will be lucky to get our refunds by next October.

If they do a third stimulus they need to wait until after the 2020 taxes are filed for that person and all tax preparers should be required to include banking info.

-

January 6, 2021 at 9:54 am #4440658GoPackGo

@Rion it’s not FAKE news if its posted front page of irs.gov

-

January 6, 2021 at 9:50 am #4440655StephanieB

I used TT as I always have for the past 7/8 years and had fees taken out. I got the first stimulus without error or delay. I haven’t received the second and GMP tool says Not available.

My transcripts say 846 1/4/2020 and have the amount. So I am very confused. ANYONE HAVE ANY IDEA what is going on?

-

January 6, 2021 at 9:45 am #4440650

Holeee fuck….why is this not surprising? Not only is it chump change, but they fucked us out of that too.

-

January 6, 2021 at 9:43 am #4440649

@givememy_money: good point. They will have to reverse the 846.

I can’t believe they won’t just issue checks instead.

-

January 6, 2021 at 9:40 am #4440647

I just wanna know how am I gonna be able to file it on my tax return if the payment is showing on my transcripts with 846 for 1/4 and I haven’t recived it? Are they gonna update my transcripts?

-

January 6, 2021 at 9:37 am #4440642

@Rion: It is literally posted on the IRS website. link above.

-

January 6, 2021 at 9:36 am #4440640

@Jaina: Yeah they said this from the gate. But I don’t think people realized how many people would be affected. And lord only knows when tax season will actually even open for people to file. We anticipated it would be 1/25, but with the legislation there were a lot of changes the IRS and tax preparers have to change to their systems. It’s a clusterfuck.

-

January 6, 2021 at 9:35 am #4440639

Fake news

-

January 6, 2021 at 9:34 am #4440638

I do not want them to send out a 2k stimulus until they have everyone’s information on file correctly. I think that when tax preparers do taxes the persons bank info should be listed on the return

-

January 6, 2021 at 9:29 am #4440636Jaina

That’s been the information. No one chooses to listen because it’s not what they want to hear. I sure as hell don’t want to hear it but it’s not really that surprising! They fuck us. That’s what they do.

-

January 6, 2021 at 9:17 am #4440615

-

January 6, 2021 at 7:59 am #4440578Lurrch

Where is this information coming from? I want to verify.

-

-

AuthorReplies

- The forum ‘2021 Tax Season’ is closed to new topics and replies.