If the IRS fraud detection filters triggered a review of your tax return for income and wage verification, it could be a hold up of your refund. So pull out your W2s and 1099s, your tax return could go old school. Why? IRS wage verification. It seems people might need evidence to prove that their documents match what was e-filed on their tax return. IRS wage verification is a trend we are seeing amongst many taxpayers who have reported their tax refunds have not been processed in under 21 days. There are many reasons why tax refunds might be delayed. We have seen a number of returns being flagged by the Taxpayer Protection Program (TPP) for Identity Theft Verification (IDV). Integrity and Verification Operation (IVO) might be the place where your tax refund could have taken a pit stop.

In the past we used to look to the date you filed your tax return as a clue to when you will receive your tax refund. Or, we compared the date accepted and the message you see on the Where’s My Refund tool. We often looked at estimates found on various tax refund calendars. But that doesn’t seem to mean a whole lot if your tax return was selected for IRS Wage Verification. Taxpayers that have reached out to us on the live igotmyrefund.com chat are reporting that they have sought help from the Taxpayer Advocate Service (TAS) and have been asked to provide copies of their W2s and 1099s. But wait we have some more questions. Didn’t I already provide W2 and 1099 information on my tax return? yep. Don’t employers submit that information? yep. Shouldn’t the IRS be able to compare the two? yep. But that might be part of the problem.

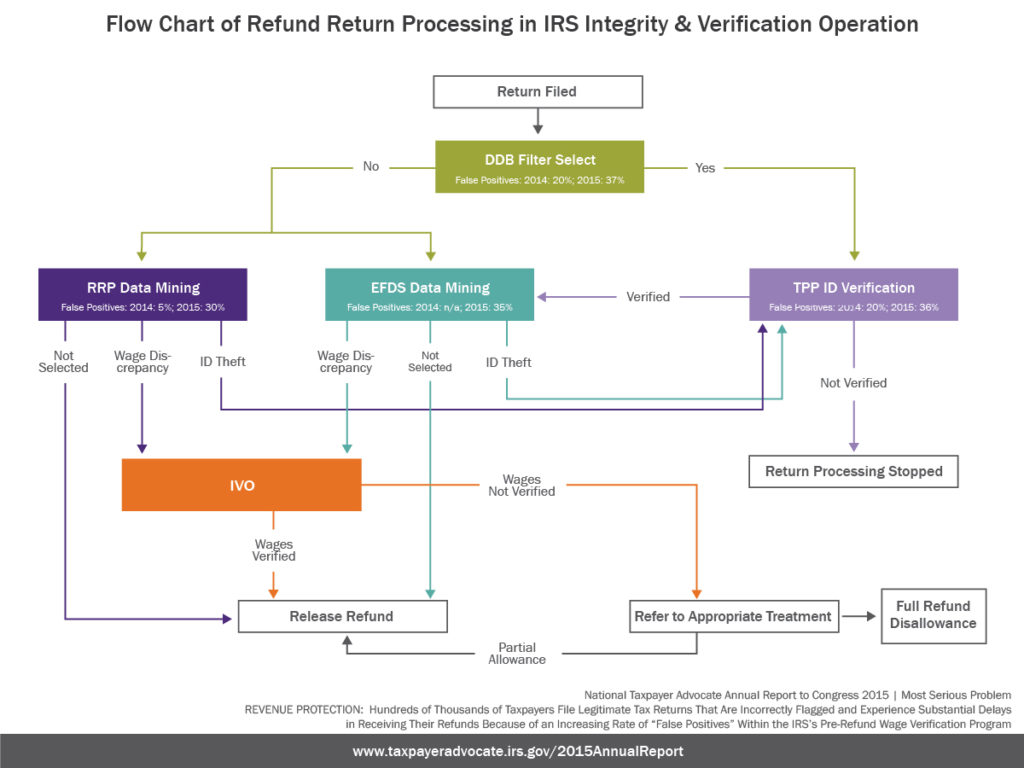

It seems like there could be some trouble with the process of IRS wage verification. Perhaps there have been a significant increase in income Wage Verification (IWV) cases. Perhaps there is a breakdown in the data sharing between Social Security Administration (SSA) and the IRS. The IRS runs tax returns through various filters to identify characteristics that may indicate a risk of fraud. It is the frontline defense for the IRS to detect potentially fraudulent returns. Perhaps tweaks to those filters are causing many more returns to be selected for review. Either way, we think the IRS might be erroneously stopping an increasing number of valid refunds. Are they legitimate returns that are false positives? Not sure yet. Since it could take several weeks for reviews to be completed, you might be in the dark. And IRS Customer Service Representatives aren’t giving up all of the details. You can get different answers to the same question depending on which representative you speak with. It was reported to us that someone called AFTER they received their refund and was told their refund was delayed due to a review. WTF? It was also reported to us by many people that their wages were off by a mere few dollars. Again, WTF?

So we did some digging on what is happening and how the process works. After putting our nose in the IRS Manual for awhile, we learned that part of the refund inquiry procedures are to tell taxpayers they have randomly been selected for review and not to mention IVO or CI. What’s that you might ask? Keep reading.

IRS Wage Verification

Will the IRS take you at your word? Nope. The IRS has integrity programs designed to detect and prevent fraud in tax returns before the IRS issues refunds. As part of the strategy for revenue protection, they screen tax returns which are scored for the likelihood of fraud. Returns that are flagged get diverted to a workflow for further inspection before a refund can be issued. The process of wage verification is complex and multi layered. It is handled by Integrity and Verification Operations (IVO) which is an IRS unit with a purpose to prevent pre-refund fraud. They perform reviews and account resolution activity. The IRS can freeze a taxpayers refund so that the IVO can verify wages and withholdings. They should send a letter explaining that income, withholding or tax credits are being reviewed. Because of the TIGTA ass chewing, we are guessing that there might have been a change to the fraud protection filters from prior years. With that, the number of IVO cases may have increased. What does that mean? Your refund could be delayed.

As part of the Path Act provisions, the IRS can’t begin providing refunds to taxpayers who claimed certain refundable credits until after Feb. 15. Issuers of Forms W-2 and 1099 were given a January 31st to file them with the government. This presumably gives the IRS extra time to verify claims and safeguard against identity theft and tax fraud. Forms 1099 are sent directly to the IRS. Forms W-2 are sent directly to the Social Security Administration (SSA), which in turn sends information extracted from the forms to the IRS each day.

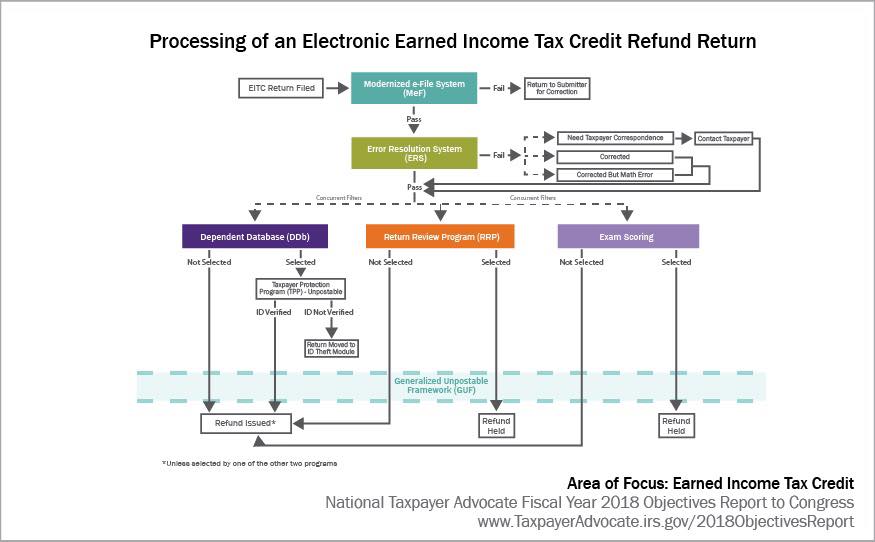

In the past, there have been some problems with wage verification according to TIGTA. There was a time that the IRS was receiving the information daily from SSA, but it was only loading it weekly into their system. Another problem identified is that some employers request extensions or miss the deadline for submitting wage and income information. And finally, it was noted that paper W-2 information is not always being sent to the SSA by January 31st. In the past, this resulted in many refunds being released that were not properly verified. A TIGTA report also mentioned a dollar threshold to trigger review of certain refunds. We don’t know how or if the IRS resolved some of these problems. But a lowered dollar threshold could cause a ton of returns to be flagged. Below you can look at the flow charts for how returns are processes in the IVO.

How will the IRS Verify my income and wages? Will they contact me or my employer?

Here is part of what happens. The IRS uses various ways to try and verify information. They coordinate with the Social Security Administration (SSA) and also have information submitted by some employers directly to the IRS to verify wages. To verify wages, they use Information Returns Master File (IRMF) which is populated with third-party information such as wage and withholding reported on Forms W-2 and 1099. If the return can’t be verified through the IRMF, next up is a manual review. The IVO will attempt to contact employers for more information. The IRS uses various method to contact employers. They generally adhere to an employer preference if one exists. Some large employers provide wage information directly to the IRS. Requests for verification are also made by fax and phone call. If IVO cannot verify the return information through either the IRMF or employer contact, they will send a letter to the taxpayer requesting documentation to substantiate information. In the letter, they may request income documentation such as copies of checks, bank statements, pay statements, check stubs, and employer letters.

What if I am off by a couple dollars?

Will the IRS fix it for me? Nope. If your return was pulled for IRS wage verification and found to be inaccurate, you will need to file an amended return. But don’t jump the gun on that. Wait until you are told to do this or get further instructions from the IRS or it could complicate matters worse.

What if I don’t have a 1099?

You might get 1099s for some of your income, for other income you might not. if you have self-employment over $400 you must report it all. If you land in the IVO, you could be needing to cough up documents to prove items claimed on a Schedule C. You might want to check out these articles for some extra reading.

IRS information on Self Employment

Publication 334, Tax Guide for Small Business

Publication 535 Business Expenses

What else could be holding up my tax refund?

There are a number of reason that tax refund could be delayed. For example, if a tax return had characteristics of identity theft, the IRS identity protection procedures might have kicked in. This is handled by Taxpayer Protection Program (TPP) and might be a pitstop for a tax refund. It could also be selected for a review of the claimed Earned Income Tax Credit (EITC). In that instance, a refund could have been stopped because of the Automated Questionable Credit (AQC) program. Worst cast scenario? If a return has suspicious characteristics, it could be under a criminal Investigation Refund Freeze.

Taxpayer Advocate Service

Many people are turning to the Taxpayer Advocate Service (TAS) to help speed things along for people who have a hardship. We have found that taxpayers have been required to send documents to them when they have been selected for IRS wage verification. The TAS is charged with helping people who are innocently caught by IRS screening and work to timely resolve cases they have accepted. Check out our post about taxpayer advocates for more information because they are inundated at this time of the year.

Here are the 2018 IRS Filing Statistics if you want to see how the IRS claims tax season is going, Also for some more reading, you might want to check out the 1/31 report from TIGTA which describes the findings for the prior year tax season and how the IRS intends to improve their processes. And some more here which discusses that the IRS still can’t verify refundable tax credits.