Avoid tax related identity theft and file taxes early. After the Equifax breach in 2017, many people may have placed a security freeze on their credit reports or began using credit monitoring services. This DOES NOT prevent tax related identity theft. There is a huge pool of potential victims. The breach put millions of tax refunds in jeopardy. Data exposed in the breach included social security numbers. Because one of the top scams on the IRS’s dirty dozen list is identity theft, the exposed social security numbers pose a large liability for taxpayers. 143 million people were affected by the Equifax breach.

Criminals are lurking and ready to file fraudulent tax returns with stolen and purchased social security numbers in hand. They are stockpiled by criminals according to the IRS Commissioner. These bad guys thrive during tax season. Beat them to the punch and file taxes early. When someone files a tax return with your Social Security number, it can be resolved, but it may take months for you to get your refund. You can avoid this by filing first. CEO and President of the Identify Theft Resource Center say “File first and beat the crooks.”

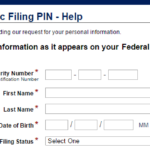

If you are using an IP Pin to file your taxes, you already have a layer of protection.

The IRS stepped up their game to prevent fraudulently filed tax returns with the use of IP Pins. But currently, using an IP Pin is only for some taxpayers. You can read more on our post about IP Pins. As a result of the breach, others who don’t have an IP Pin should consider filing their tax returns early.

Avoiding filing because of the new tax laws?

Don’t worry about it. Most people don’t have to worry about the recently passed tax laws because they won’t affect your 2017 tax return. You can read our recent post for what you need to know about the new tax laws.

Don’t rush too much.

We don’t suggest rushing to much. Avoid underreporting income and using a paystub to file your taxes. For some people, filing their tax return goes well beyond a W-2. Make sure you have all your tax related documents before filing. Filing an incomplete or inaccurate return can result in you having to file an amended return later and can be another headache.