2024 IRS Transcript with 846

Requesting your IRS Transcript online at irs.gov is the fastest way to get a transcript. Request an account transcript to look at the codes.

Read more: How to check and read your IRS transcript.

2024 IRS Transcript with 846 – Cycle Code 20240402

2023 IRS Transcript with 846 – Cycle Code 20230602

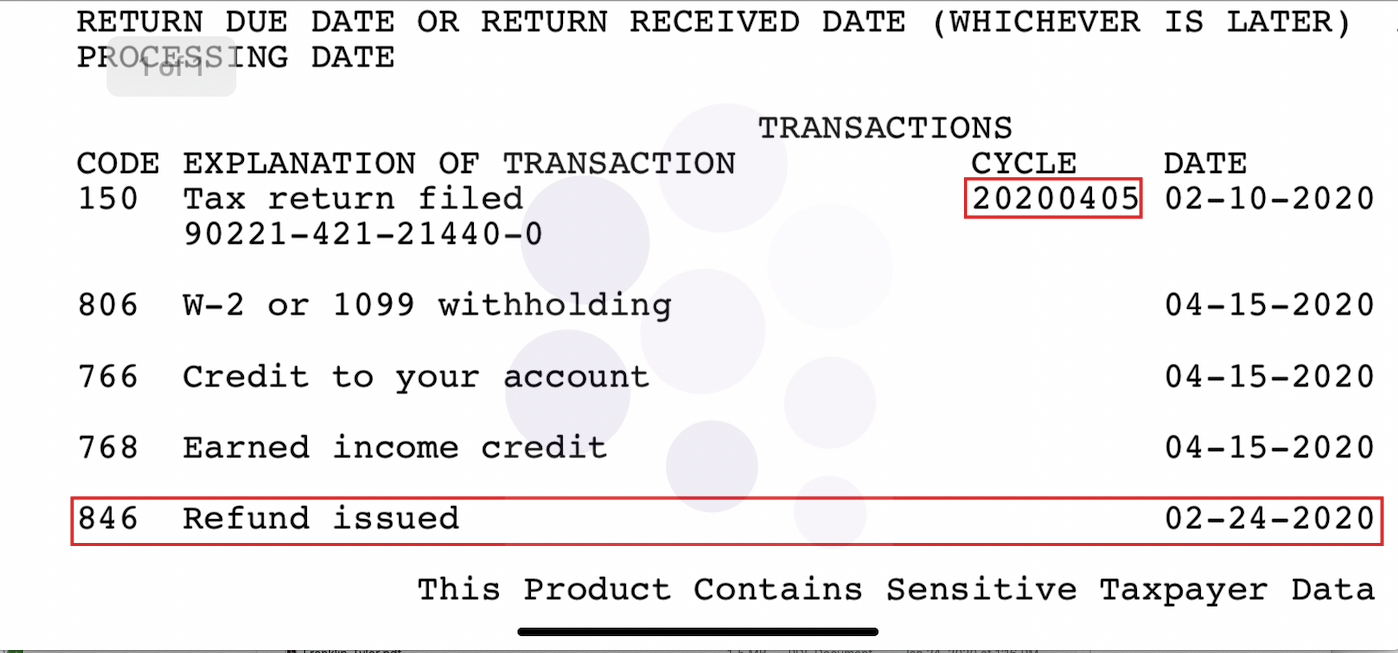

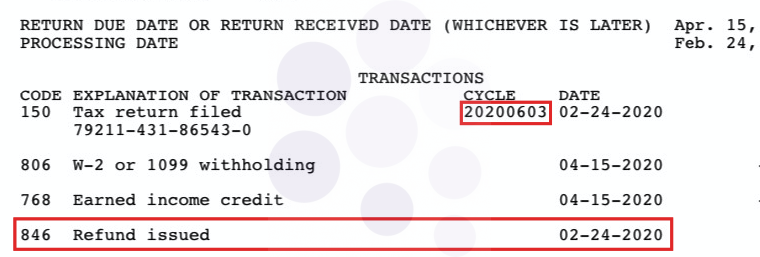

2020 IRS Transcript with 846 – Cycle Code 20200403

Comments are closed.